First Quarter, 2025

Click here for a printable version of the Investment Update.

Chevy Chase Trust’s unique approach to Thematic Investing weaves together multiple themes across sectors, geographies, and industries, each designed to capitalize on research-driven insights. Listen to our quarterly update of economic conditions and investment strategy.

Everything we do starts with a conversation. Understanding your unique story is key in the development of a plan with your best interests in mind. To connect with us to learn more and begin a conversation, visit chevychasetrust.com.

To read the Q3 2025 Investment Update, visit https://chevychasetrust.com/third-quarter-2025/. For more information about Chevy Chase Trust, visit chevychasetrust.com.

Important Disclosures This commentary is for informational purposes only. The information set forth herein is of a general nature and does not address the circumstances of any particular individual or entity. You should not construe any information herein as legal, tax, investment, financial or other advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. This commentary includes forward-looking statements, and actual results could differ materially from the views expressed. Materials referenced that were published by outside sources are included for informational purposes only. These sources contain facts and statistics quoted that appear to be reliable, but they may be incomplete or condensed and we do not guarantee their accuracy. Fact and circumstances may be materially different between the time of publication and the present time. Clients with different investment objectives, allocation targets, tax considerations, brokers, account sizes, historical basis in the applicable securities or other considerations will typically be subject to differing investment allocation decisions, including the timing of purchases and sales of specific securities, all of which cause clients to achieve different investment returns. Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any historical performance level(s), be suitable for the portfolio or individual situation of any particular client, or otherwise prove successful. Investing involves risks, including the risk of loss of principal. The level of risk in a client’s portfolio will correspond to the risks of the underlying securities or other assets, which may decrease, sometimes rapidly or unpredictably, due to real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict, trade disputes, sanctions or other government actions, or other general market conditions or factors. Actively managed portfolios are subject to management risk, which involves the chance that security selection or focus on securities in a particular style, market sector or group of companies will cause a portfolio to incur losses or underperform relative to benchmarks or other portfolios with similar investment objectives. Foreign investing involves special risks, including the potential for greater volatility and political, economic and currency risks. Please refer to Chevy Chase Trust’s Form ADV Part 2 Brochure, a copy of which is available upon request, for a more detailed description of the risks associated with Chevy Chase Trust’s investment strategy. The recipient assumes sole responsibility of evaluating the merits and risks associated with the use of any information herein before making any decisions based on such information.

April 5, 2025

We penned the attached first quarter 2025 Investment Update before the Trump Administration’s April 2nd tariff announcement and the strong reactions from trading partners and financial markets.

In our Global Thematic Equity research, we try to focus beyond the noise of the short-term news cycle, as we pursue long-term investment opportunities brought about by broad secular trends that impact corporate performance and stock valuations across geographies and sectors.

Occasionally, however, the news of the moment has long-term implications for businesses and investors. We believe this is one of those times. The new tariffs upend the calculus that business leaders have used to make decisions for decades. Therefore, they require careful consideration.

These tariffs also constitute the largest peace-time tax increase in U.S. history. Yet to be determined is how much of that tax will be borne by consumers versus companies. If unchanged, the tariffs will reduce corporate profitability and raise the risk of a U.S. recession. Retaliatory tariffs likely to be enacted in response by other countries would reduce demand for U.S. exports. $8 trillion in annual sales generated by foreign subsidiaries of U.S.-domiciled multinationals are also now in jeopardy.

Understandably, these changes have roiled equity markets. The S&P 500 declined 11% in the two trading days after the announcement. The index is now down 14% year-to-date.

In addition to studying significant near-term, first-order impacts, we are focused on understanding longer-term, second- and third-order impacts that may outlast this tariff regime, particularly if the announced tariffs are merely a starting point for negotiation, as some posit. This radical pivot in trade policy is only one of several changes that are recasting the role of the U.S. on the global stage, increasing the importance of our Opportunities Abound Abroad investment theme.

While these events are deeply unsettling, we believe our time-tested investment process will help us to navigate this policy-induced volatility with a clear-eyed, long-term perspective that will ultimately benefit our clients.

During this tumultuous period, please reach out to us, or to our wealth advisors and portfolio managers, who remain intensively focused on the opportunities and risks of this moment.

Sincerely,

In the first quarter of 2025, financial markets started to reflect several of the risks we noted in our Fourth Quarter 2024 Investment Update. Already grappling with high levels of uncertainty, U.S. companies and consumers started to defer spending and investment. This is an environment for which we have prepared; we will try to navigate it with equal measures of ambition and caution.

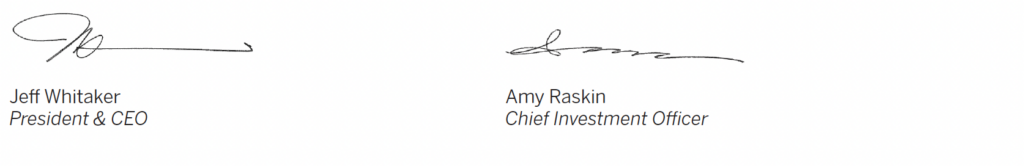

U.S. financial markets had an unsettling first quarter. After starting out strong, with the S&P 500 reaching an all-time high of 6,144 on February 19, the index dropped 10% through March 13, wiping out more than $5 trillion of U.S. equity market capitalization in just three weeks. Non-U.S. equities, however, rose nicely.

The MSCI All Country World Index excluding the U.S. (ACWI ex U.S.) finished the quarter up 4.6%, driven by double-digit increases in Germany, Hong Kong, Spain and Brazil. The S&P 500 ended at 5,612, down 4.6%, delivering its worst quarterly performance relative to the ACWI ex U.S. in over 15 years.

These results defied widespread expectations at the start of 2025 for continued strong U.S. equity market performance and weakness in the rest of the world.

We didn’t share in consensus expectations. In our Fourth Quarter 2024 Investment Update, we stated that, in our view, “U.S. equity market valuations fully reflect both recent good news and expectations of more, increasing the risk of a correction.” We listed seven risks to the S&P 500’s extraordinary run: very high expectations, valuations near record highs, U.S. equity domination, unprecedented market concentration, high bond yields, policy risk and extremely broad and high levels of equity ownership.

Clearly, trade worries weighed on investor sentiment in the latter half of the first quarter. We believe two other factors were also meaningful contributors to U.S. market declines:

A newfound measure of realism about the future profitability of artificial intelligence (AI) and continued cash flow growth for the Magnificent 71

TRADE AND TARIFFS: ONLY PART OF THE STORY

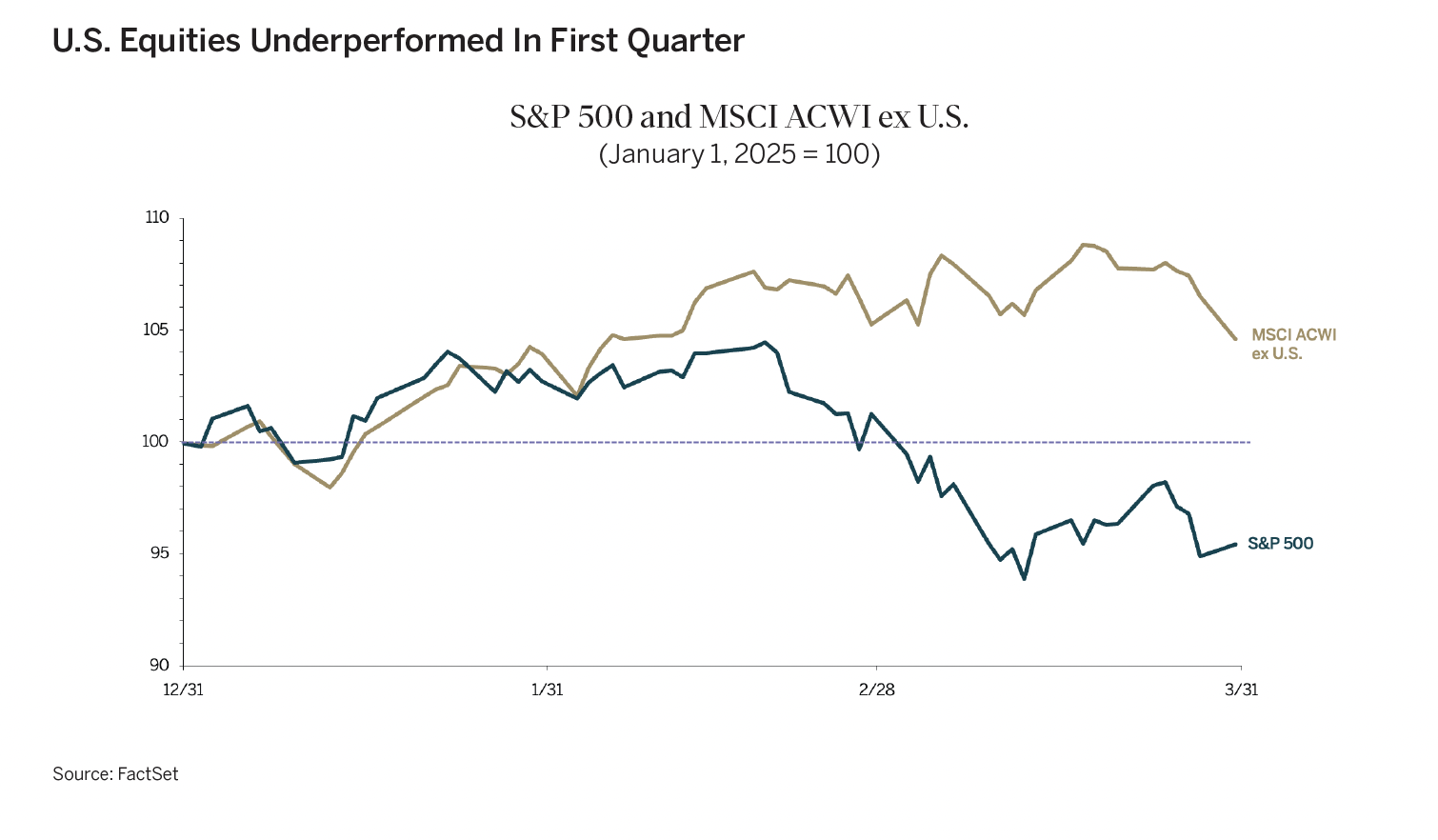

During the first quarter, the Trump Administration imposed the highest U.S. tariffs in almost a century, called them off, put them back and threatened more to come, driving the Trade Policy Uncertainty Index to a record high.

High tariffs are likely to depress trade and raise consumer prices, if left in place. Uncertainty about tariffs and other policies has already had negative effects. Many businesses are delaying capital investments and hiring until they have more clarity on policy decisions that could affect their return on investments. Wealthy U.S. households have also cut spending due to concerns about an equity market decline. As a result, many Wall Street economists lowered their forecasts for U.S. GDP growth in 2025.

Nonetheless, tariff uncertainty doesn’t seem to fully explain the drop in U.S. equities in the first quarter. Many international equity markets that appear to be vulnerable to the new tariff policy performed remarkably well. Some highly cyclical sectors, such as energy, also rose.

AI REALITY BITES THE MAG 7

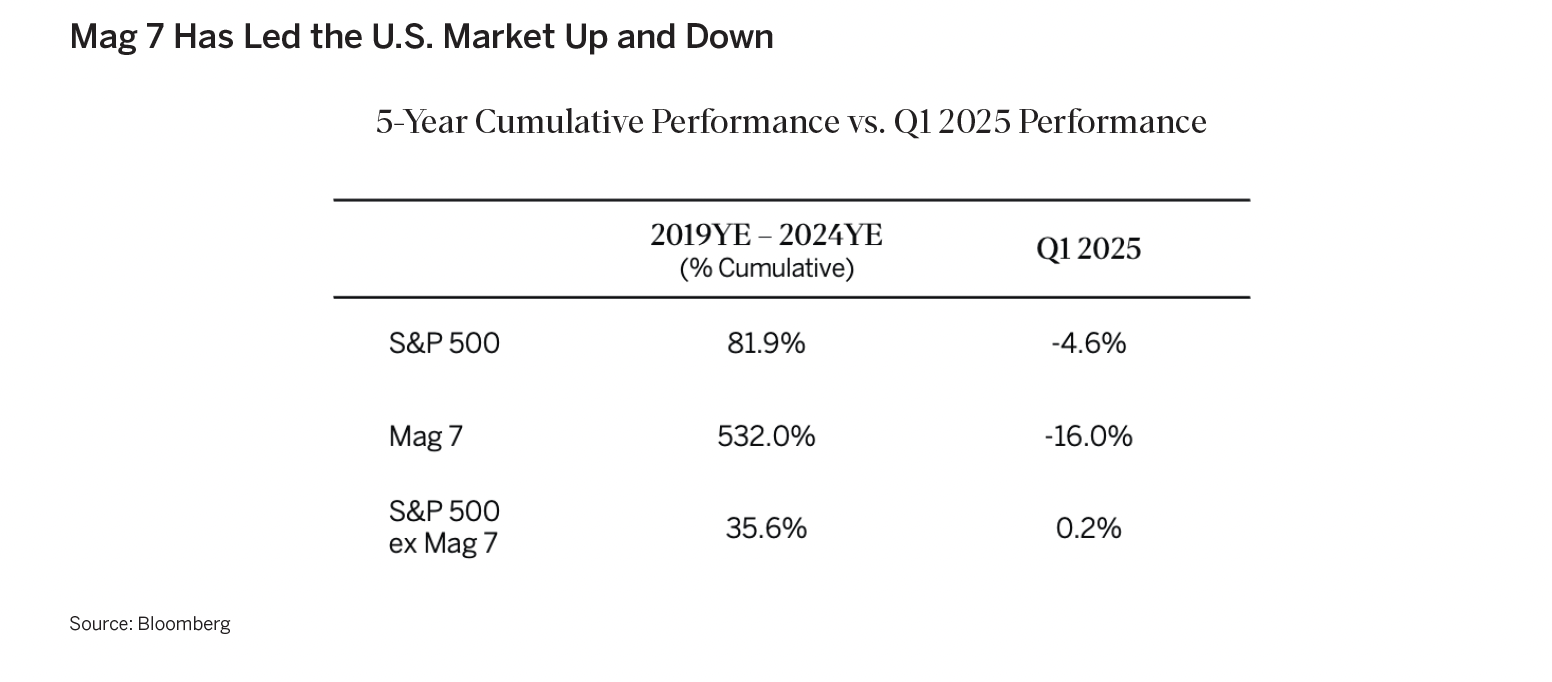

The Mag 7 fell by just over 16% in the quarter and are well off their all-time highs. Since they collectively represented more than one-third of the S&P 500 when the year began, they dragged the index down, after powering it higher for the past five years.

We suspect that the Mag 7 declined in the first quarter because of growing skepticism that AI will become profitable near term. Most of the Mag 7 are quasi-monopolies. It is hard to see how investing hundreds of billions of dollars in new infrastructure will make these companies more profitable than they already are. Furthermore, history shows that major shifts to new technologies have tended to disrupt the existing market hierarchy, not reinforce it.

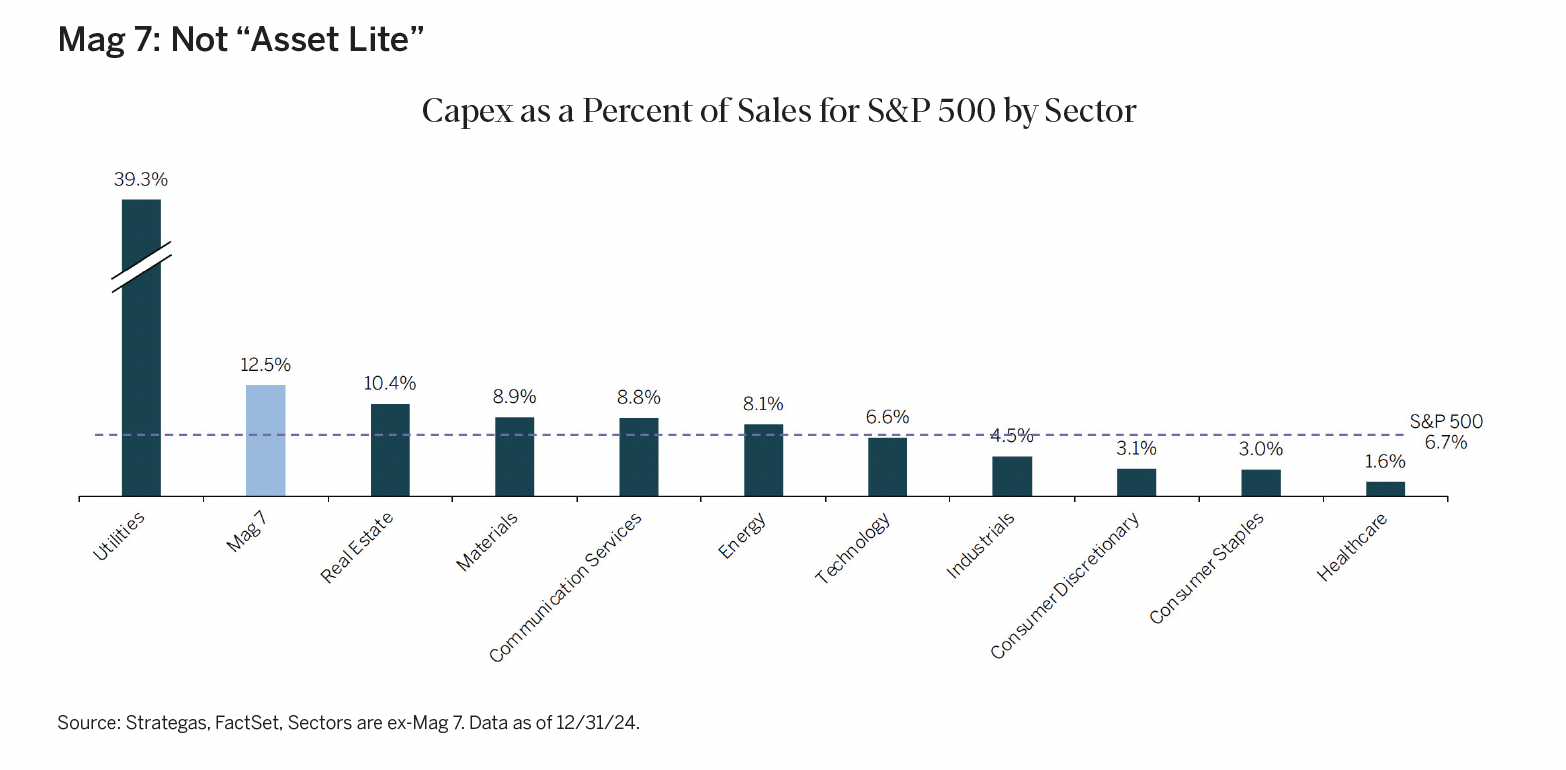

Concerns about Mag 7 valuations may have also taken a toll. At year-end 2024, the Mag 7 were selling at extremely high valuations: about 44 times earnings on average, including 124 times earnings for Tesla. In recent years, many analysts have justified Mag 7 valuations by citing their low capital-spending burdens. But now, the Mag 7 are spending heavily on server farms and other assets in response to the AI opportunity. As a result, the Mag 7 have higher capital expenditures relative to sales than any other sector, except utilities.

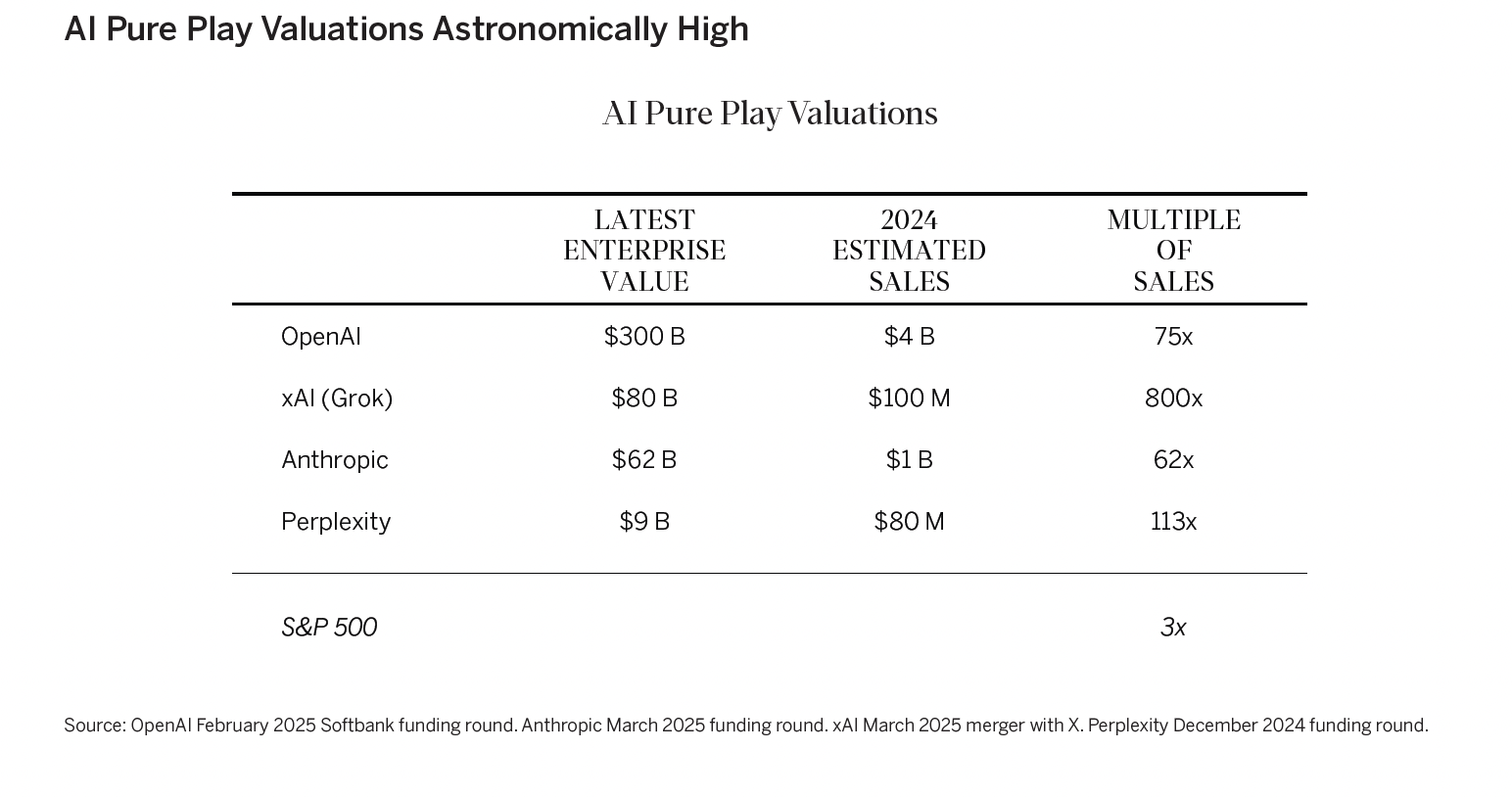

As usual, some enthusiasts claim, “this time is different.” Unlike the market favorites during the tech bubble of the late 1990s, they say, the Mag 7 companies that are investing heavily in AI are profitable and cash-flow positive. We think that story is dubious at best. We suspect that the Mag 7’s AI businesses would be revealed as deeply unprofitable if we could separate them from the cash-cow, quasi-monopoly businesses that support them. Privately held pure-play AI companies are valued at extraordinarily high multiples of minimal sales and are incurring huge losses.

FOREIGN CAPITAL FLOWS MATTER (BOTH IN AND OUT)

Repatriation of foreign funds was another driver of the market drop in the first quarter. For many years, three concurrent factors made U.S. equities very alluring to non-U.S. investors: relatively strong U.S. economic growth, strong equity market outperformance and U.S. dollar appreciation. Much of the S&P 500’s 150% rise since January 2019 was due to unprecedented buying from outside the U.S. In aggregate, non-U.S. investors increased their holdings of U.S. equities by almost $10 trillion over five years, while the value of non-U.S. holdings by U.S. equity investors “only” increased by about $2 trillion.

The situation changed in the first quarter. Some non-U.S. investors withdrew from U.S. markets, due at least in part to the sharp rise in political tensions between the U.S. and its long-time allies. For example, the Danish teachers’ pension fund, AkademikerPension, with roughly $20 billion of assets under management, said it would sell its remaining Telsa shares, mainly in response to Elon Musk’s interference in European politics. The U.K. government is pressuring pension funds to commit 10% of their assets to British equities, up from roughly 4% today. Canada is similarly exerting pressure on institutions to bring assets “home”.

If the first quarter is a harbinger of things to come, outflows could weigh heavily on U.S. equities. There are also non-political reasons to expect U.S. and non-U.S. investors to diversify equity holdings into other geographies.

THEMATIC UPDATE – OPPORTUNITIES ABOUND ABROAD

Over the last 15 years, U.S. nominal GDP grew 94%, well above the 10.5% average for the Group of 7 nations2 excluding the U.S. Over the same period, the S&P 500 rose 427%, while the MSCI ACWI ex U.S. rose only 34%. The U.S. dollar also appreciated sharply versus its trade-weighted index.

There were many reasons for U.S. economic and financial market outperformance in this period. Europe was beset by integration issues and the Sovereign Debt Crisis of 2012-2013. The U.K. vote in 2016 to leave the European Union inflicted further damage. Japan was struggling with the challenge of an aging population, sustained deflation, competition from China, and a weakening yen. Meanwhile, rapid earnings growth from the U.S. tech sector contributed to outsized profits for U.S. companies.

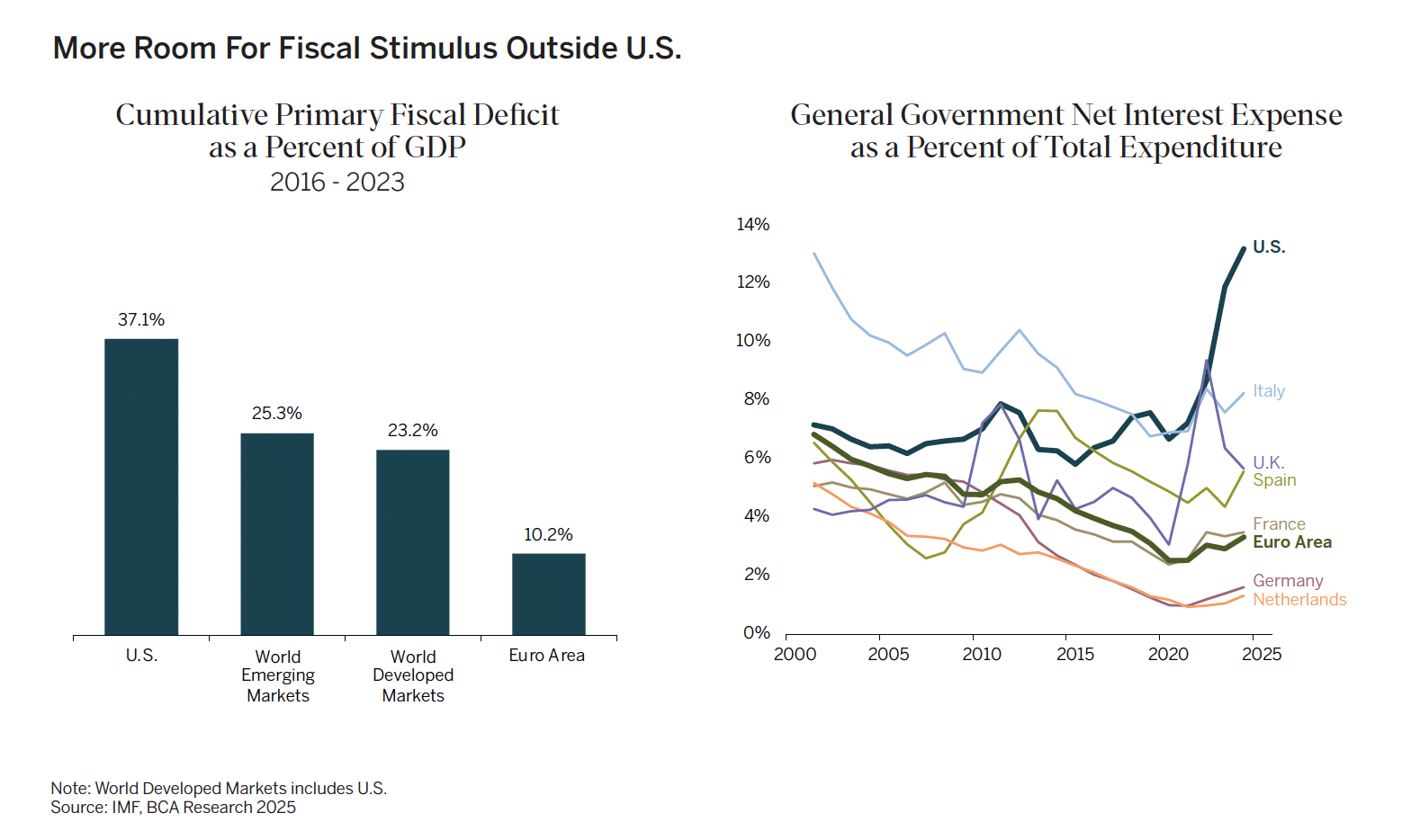

A more prosaic explanation for faster economic growth in the U.S. gets less attention: greater U.S. fiscal stimulus. The U.S. government has spent lavishly and cut taxes to support economic growth over the past 10 years, while other nations ran much smaller deficits relative to their economies’ sizes.

This situation isn’t likely to last. Until 2022, extremely low interest rates allowed the U.S. to accumulate increasingly higher levels of debt without interest expense spiraling out of control. However, the higher interest rates of the last few years have caused interest expense to soar. Today, interest expense is a greater share of total expenditures in the U.S. than it is in Italy, a country long associated with fiscal profligacy.

Important Disclosures This commentary is for informational purposes only. The information set forth herein is of a general nature and does not address the circumstances of any particular individual or entity. You should not construe any information herein as legal, tax, investment, financial or other advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. This commentary includes forward-looking statements, and actual results could differ materially from the views expressed. Materials referenced that were published by outside sources are included for informational purposes only. These sources contain facts and statistics quoted that appear to be reliable, but they may be incomplete or condensed and we do not guarantee their accuracy. Fact and circumstances may be materially different between the time of publication and the present time. Clients with different investment objectives, allocation targets, tax considerations, brokers, account sizes, historical basis in the applicable securities or other considerations will typically be subject to differing investment allocation decisions, including the timing of purchases and sales of specific securities, all of which cause clients to achieve different investment returns. Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any historical performance level(s), be suitable for the portfolio or individual situation of any particular client, or otherwise prove successful. Investing involves risks, including the risk of loss of principal. The level of risk in a client’s portfolio will correspond to the risks of the underlying securities or other assets, which may decrease, sometimes rapidly or unpredictably, due to real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict, trade disputes, sanctions or other government actions, or other general market conditions or factors. Actively managed portfolios are subject to management risk, which involves the chance that security selection or focus on securities in a particular style, market sector or group of companies will cause a portfolio to incur losses or underperform relative to benchmarks or other portfolios with similar investment objectives. Foreign investing involves special risks, including the potential for greater volatility and political, economic and currency risks. Please refer to Chevy Chase Trust’s Form ADV Part 2 Brochure, a copy of which is available upon request, for a more detailed description of the risks associated with Chevy Chase Trust’s investment strategy. The recipient assumes sole responsibility of evaluating the merits and risks associated with the use of any information herein before making any decisions based on such information.