Fourth Quarter, 2024

Click here for a printable version of the Investment Update.

To listen to our Q4 2024 Investment Update, follow and subscribe to Chevy Chase Trust on Apple Podcasts, Pandora or Spotify.

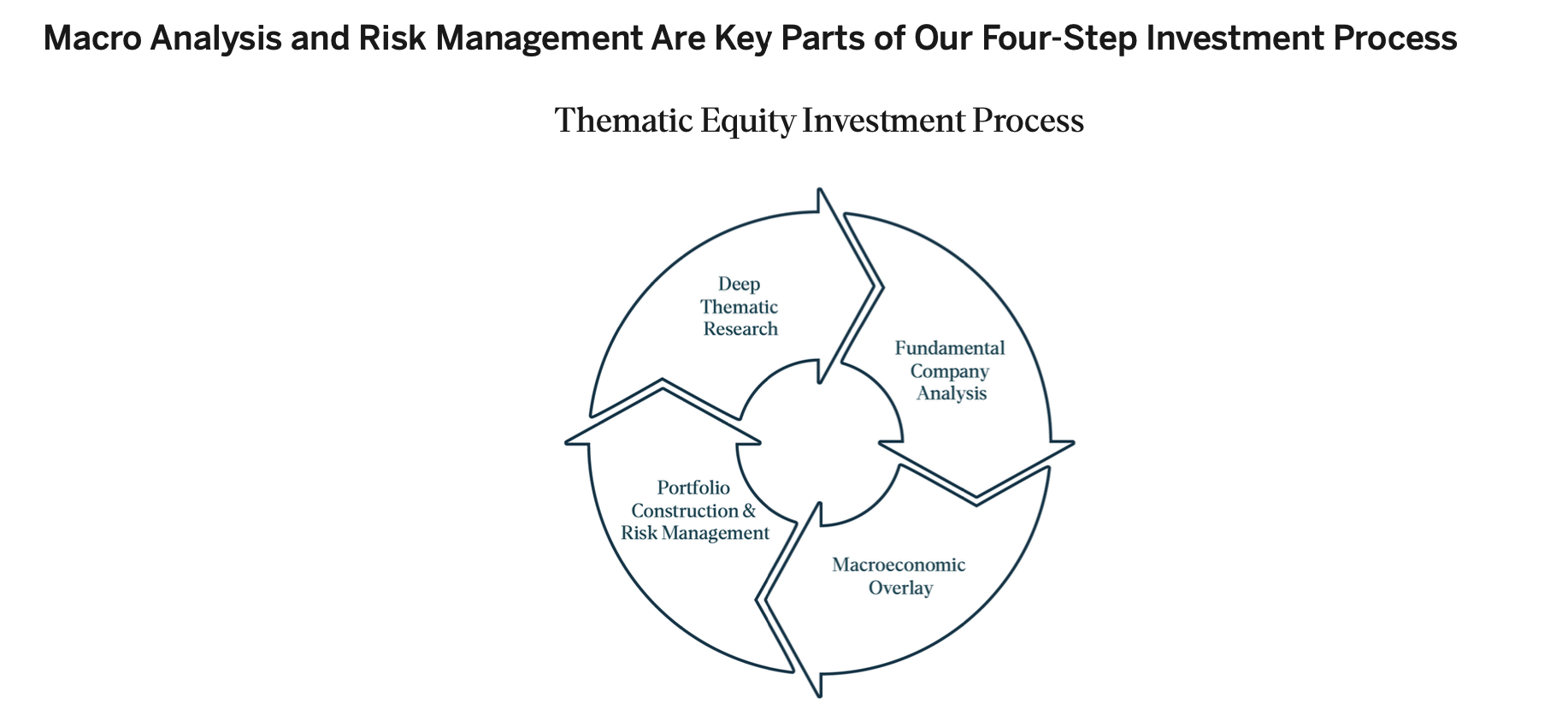

Chevy Chase Trust’s unique approach to Thematic Investing weaves together multiple themes across sectors, geographies, and industries, each designed to capitalize on research-driven insights. Listen to our quarterly update of economic conditions and investment strategy.

Everything we do starts with a conversation. Understanding your unique story is key in the development of a plan with your best interests in mind. To connect with us to learn more and begin a conversation, visit chevychasetrust.com.

To read the Q4 2025 Investment Update, visit https://chevychasetrust.com/fourth-quarter-2025/. For more information about Chevy Chase Trust, visit chevychasetrust.com.

Important Disclosures This commentary is for informational purposes only. The information set forth herein is of a general nature and does not address the circumstances of any particular individual or entity. You should not construe any information herein as legal, tax, investment, financial or other advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. This commentary includes forward-looking statements, and actual results could differ materially from the views expressed. Materials referenced that were published by outside sources are included for informational purposes only. These sources contain facts and statistics quoted that appear to be reliable, but they may be incomplete or condensed and we do not guarantee their accuracy. Fact and circumstances may be materially different between the time of publication and the present time. Clients with different investment objectives, allocation targets, tax considerations, brokers, account sizes, historical basis in the applicable securities or other considerations will typically be subject to differing investment allocation decisions, including the timing of purchases and sales of specific securities, all of which cause clients to achieve different investment returns. Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any historical performance level(s), be suitable for the portfolio or individual situation of any particular client, or otherwise prove successful. Investing involves risks, including the risk of loss of principal. The level of risk in a client’s portfolio will correspond to the risks of the underlying securities or other assets, which may decrease, sometimes rapidly or unpredictably, due to real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict, trade disputes, sanctions or other government actions, or other general market conditions or factors. Actively managed portfolios are subject to management risk, which involves the chance that security selection or focus on securities in a particular style, market sector or group of companies will cause a portfolio to incur losses or underperform relative to benchmarks or other portfolios with similar investment objectives. Foreign investing involves special risks, including the potential for greater volatility and political, economic and currency risks. Please refer to Chevy Chase Trust’s Form ADV Part 2 Brochure, a copy of which is available upon request, for a more detailed description of the risks associated with Chevy Chase Trust’s investment strategy. The recipient assumes sole responsibility of evaluating the merits and risks associated with the use of any information herein before making any decisions based on such information.

The S&P 500 delivered another year of exceptional returns in 2024. It’s been quite a run. Today, U.S. equity market valuations fully reflect both recent good news and expectations of more, increasing the risk of a correction if inflation picks up, the economy slows or anything else goes wrong. We see the broad markets as less attractive than 12 months ago, but we’re still finding opportunities in individual companies at home and abroad that we believe will better withstand – or even benefit from – the challenges and disruption that may lie ahead.

INVESTING IN FROTHY MARKETS

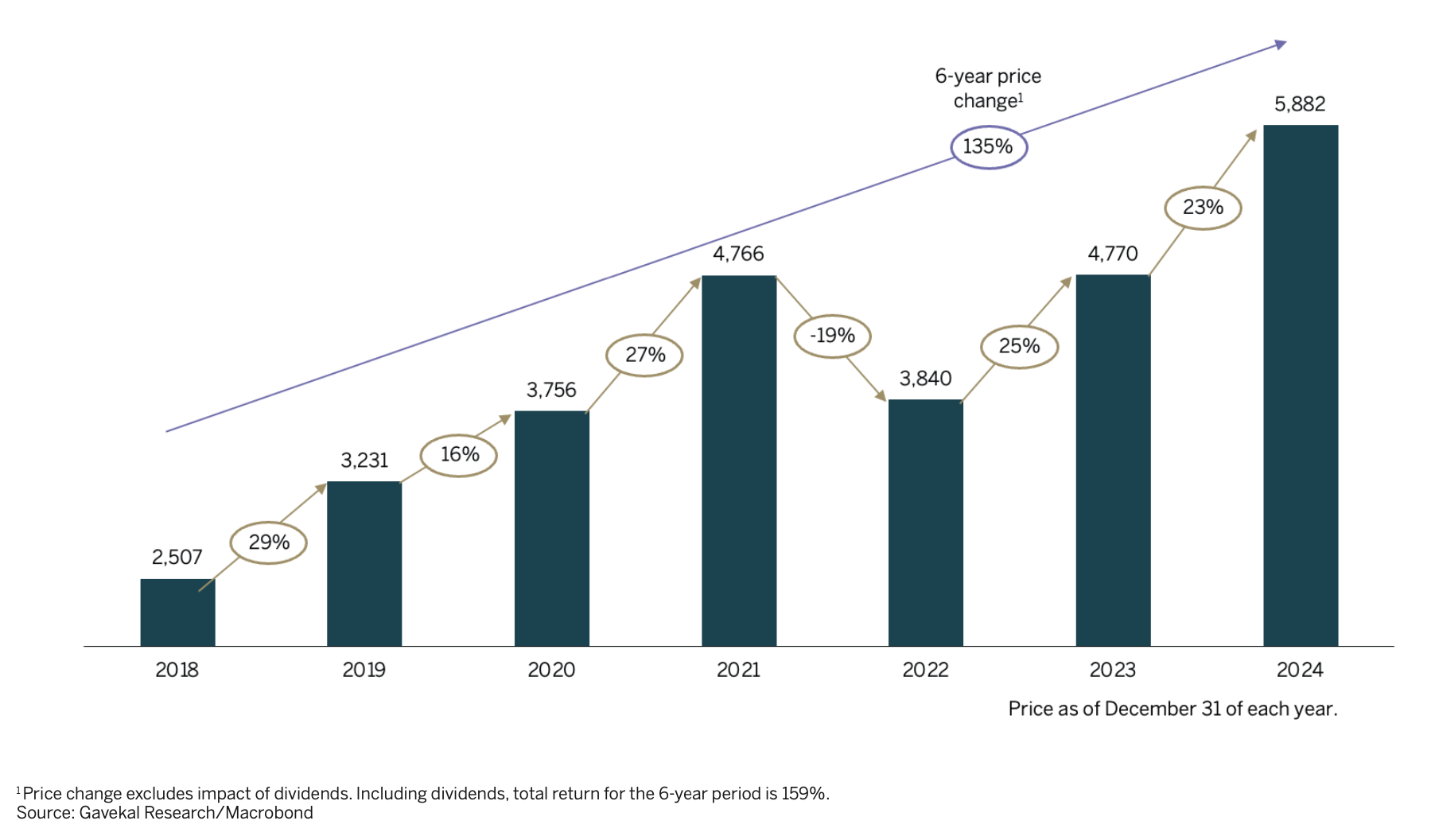

It was another very strong year for global equity markets, and the U.S. again performed better than most. While the MSCI All-Country World Index generated a total return of 18% in 2024, the S&P 500 Index returned 25%.

The S&P 500 delivered similarly strong returns in 2023, and double-digit returns in five of the past six years. Its price has more than doubled from 2,507 at the start of 2019 to 5,882 at 2024’s close. In contrast, U.S. Treasuries have delivered four consecutive years of negative returns.

SOLID FUNDAMENTALS AND FROTH

There were good reasons for equity market strength in recent years. U.S. economic growth has beaten low expectations, and there still isn’t a recession in sight. In addition, inflation has fallen sharply from its highs of two years ago, prompting the Federal Reserve to lower its benchmark discount rate repeatedly, from 5.25%-5.50% in early September to 4.25%-4.50% at year end. Most analysts expect the Fed to continue cutting interest rates. There is also widespread optimism that the incoming Trump Administration will slash regulations and corporate tax rates, and that artificial intelligence (AI) will improve productivity.

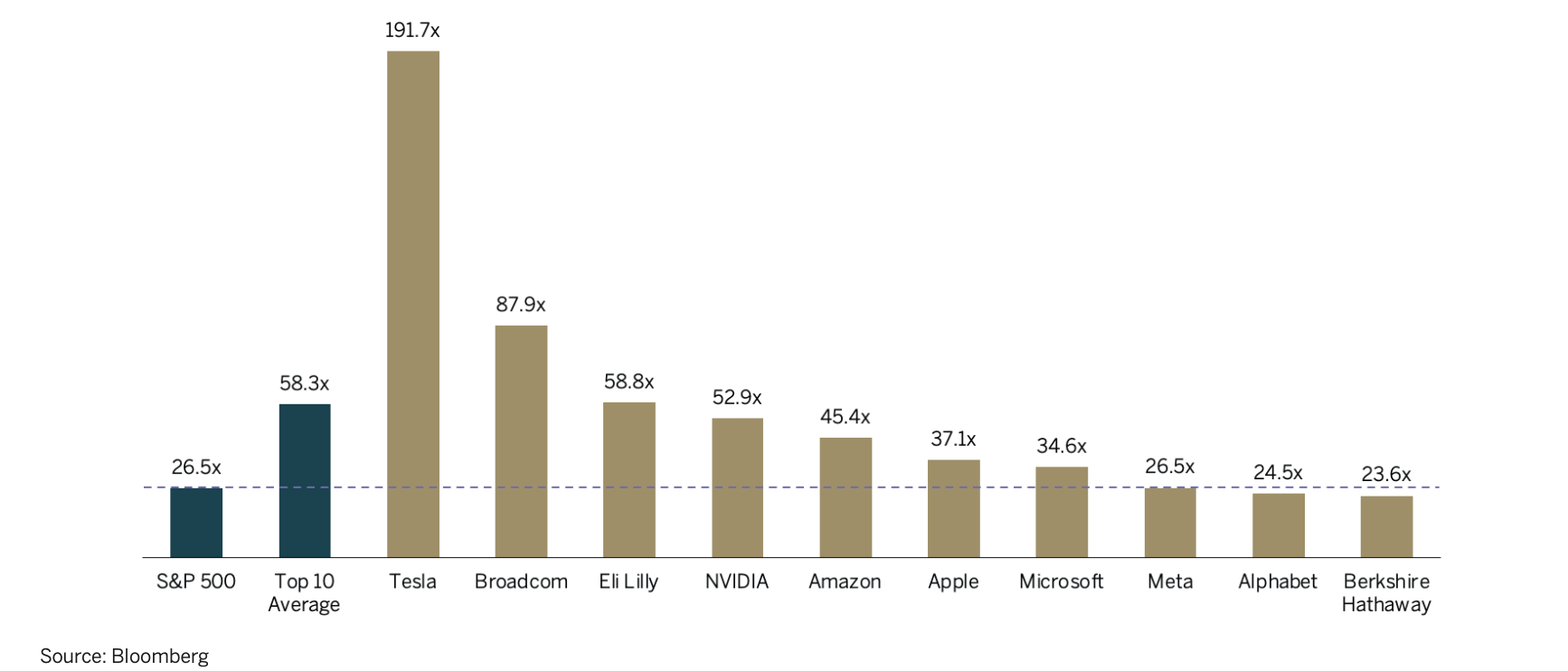

But this “good news” is already reflected in share prices, and there are clear signs of froth. Consider:

- The sudden surge in cryptocurrency prices

- Massive retail inflows into speculative corners of the market, such as leveraged ETFs and options with zero days to expiration

- Stock valuations that imply that every company related to AI will capture a significant share of a massive and highly profitable new market

SEVEN (OF MANY) RISKS TO CONSIDER

For the reasons below, we have worked over the past year to reduce risk in clients’ equity portfolios, and we think it prudent to position more defensively for 2025.

1. High Expectations: At the beginning of 2024, Wall Street economists were bearish, expecting the S&P 500 to rise by just 2% for the year, well below its long-term average annual gain. Instead, the Index rose far more than average. In contrast, the same economists now expect 2025 to be a banner year for equities, projecting above average returns despite slowing revenue growth and margins already near record highs.

Important Disclosures This commentary is for informational purposes only. The information set forth herein is of a general nature and does not address the circumstances of any particular individual or entity. You should not construe any information herein as legal, tax, investment, financial or other advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. This commentary includes forward-looking statements, and actual results could differ materially from the views expressed. Materials referenced that were published by outside sources are included for informational purposes only. These sources contain facts and statistics quoted that appear to be reliable, but they may be incomplete or condensed and we do not guarantee their accuracy. Fact and circumstances may be materially different between the time of publication and the present time. Clients with different investment objectives, allocation targets, tax considerations, brokers, account sizes, historical basis in the applicable securities or other considerations will typically be subject to differing investment allocation decisions, including the timing of purchases and sales of specific securities, all of which cause clients to achieve different investment returns. Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any historical performance level(s), be suitable for the portfolio or individual situation of any particular client, or otherwise prove successful. Investing involves risks, including the risk of loss of principal. The level of risk in a client’s portfolio will correspond to the risks of the underlying securities or other assets, which may decrease, sometimes rapidly or unpredictably, due to real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict, trade disputes, sanctions or other government actions, or other general market conditions or factors. Actively managed portfolios are subject to management risk, which involves the chance that security selection or focus on securities in a particular style, market sector or group of companies will cause a portfolio to incur losses or underperform relative to benchmarks or other portfolios with similar investment objectives. Foreign investing involves special risks, including the potential for greater volatility and political, economic and currency risks. Please refer to Chevy Chase Trust’s Form ADV Part 2 Brochure, a copy of which is available upon request, for a more detailed description of the risks associated with Chevy Chase Trust’s investment strategy. The recipient assumes sole responsibility of evaluating the merits and risks associated with the use of any information herein before making any decisions based on such information.