Fourth Quarter, 2025

Click here for a printable version of the Investment Update.

Listen to our latest Investment Update on Apple Podcasts, Pandora or Spotify.

After a year of exceptionally strong returns globally, we expect more muted performance in equity markets in the year ahead. We are excited, however, by the dynamics unfolding for our investment themes, which we believe provide excellent hunting grounds for companies with significant, long-term share price appreciation.

THE BULL MARKET CHARGED AHEAD

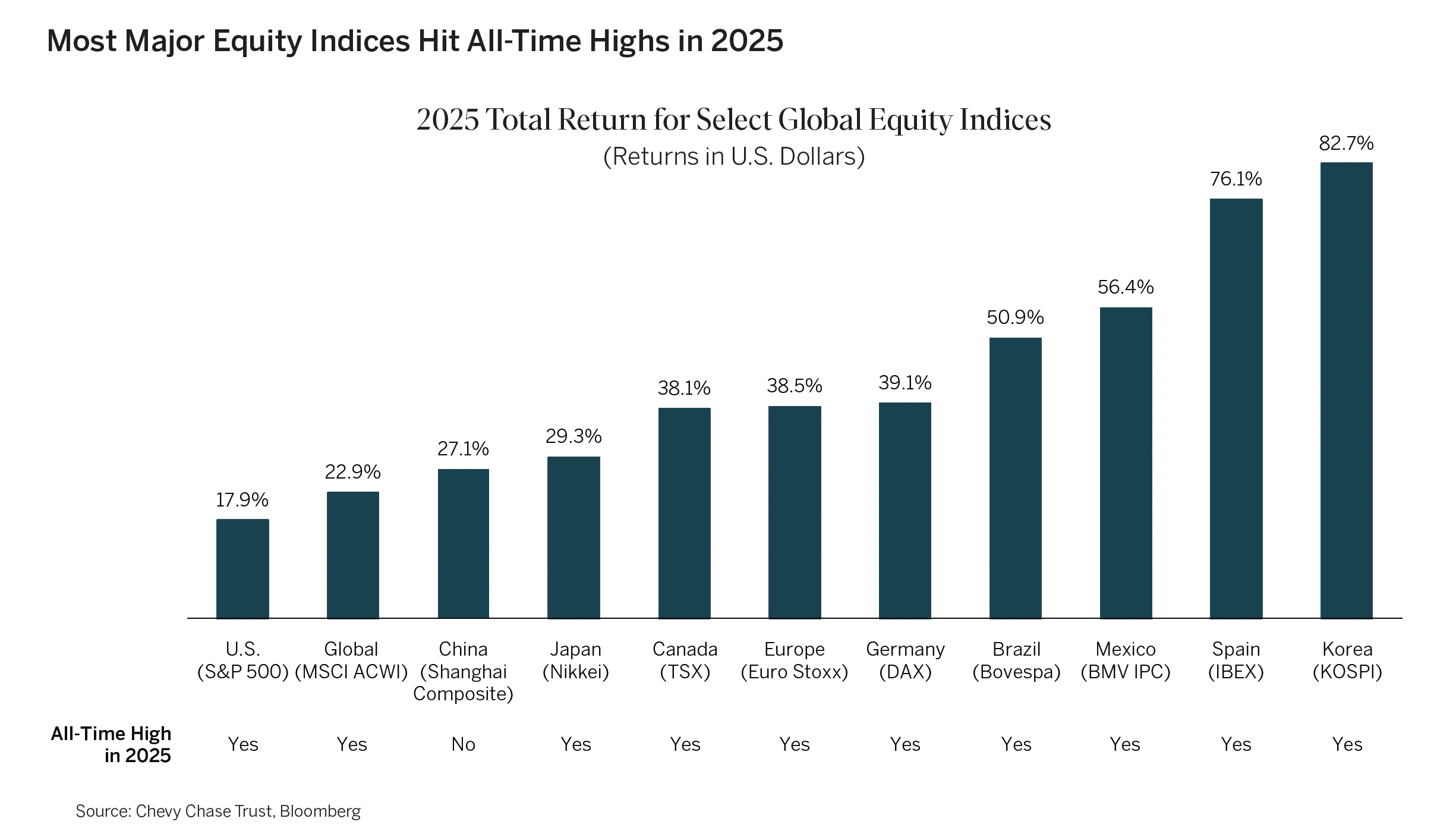

It was a great year for equity investors globally. Most major indices touched all-time highs during 2025. Fiscal stimulus, low and falling short-term interest rates in much of the world and relatively low energy prices drove the broadest global equity market rally since 2007.

HOW LONG CAN THE GOOD TIMES ROLL?

The S&P 500 closed 2025 more than 90% above its October 2022 low. In each of the past three calendar years, the index’s total return exceeded 17%. Such strong returns seem unlikely in 2026. The last time the S&P 500 delivered double-digit returns for four consecutive years was during the tech and telecom bubble of the late 1990s. The time before that was way back in the 1950s.

As Yogi Berra once quipped, “Predictions are hard – especially about the future.” Many upcoming events could have a big impact on the economy and financial market performance in 2026. These include the Supreme Court decision on the legality of the 2025 tariffs, the naming of a new Chairman of the U.S. Federal Reserve (Fed), the path of unemployment and interest rates and any change in the consensus on the ultimate profitability of artificial intelligence (AI).

Despite the uncertainty resulting from the factors listed above, several tailwinds should support continued U.S. and global economic growth. In addition to relatively low oil prices and the expected impact of the Fed’s 175 basis points of interest-rate cuts since September 2024, the U.S. consumer will receive generous tax refunds in the first half of 2026 from the One Big Beautiful Bill Act. U.S. companies will also pay lower effective tax rates, due to provisions in the bill designed to stimulate capital investment. Europe and Japan also appear to be willing to dole out ample fiscal largesse in the year ahead.

While we believe the odds are in favor of solid economic growth in 2026, there are three areas of concern that bear watching. Each is likely to weigh more on U.S. equity market performance than the economy, but a stock market decline could depress consumer and corporate spending, which would lead to slower economic growth.

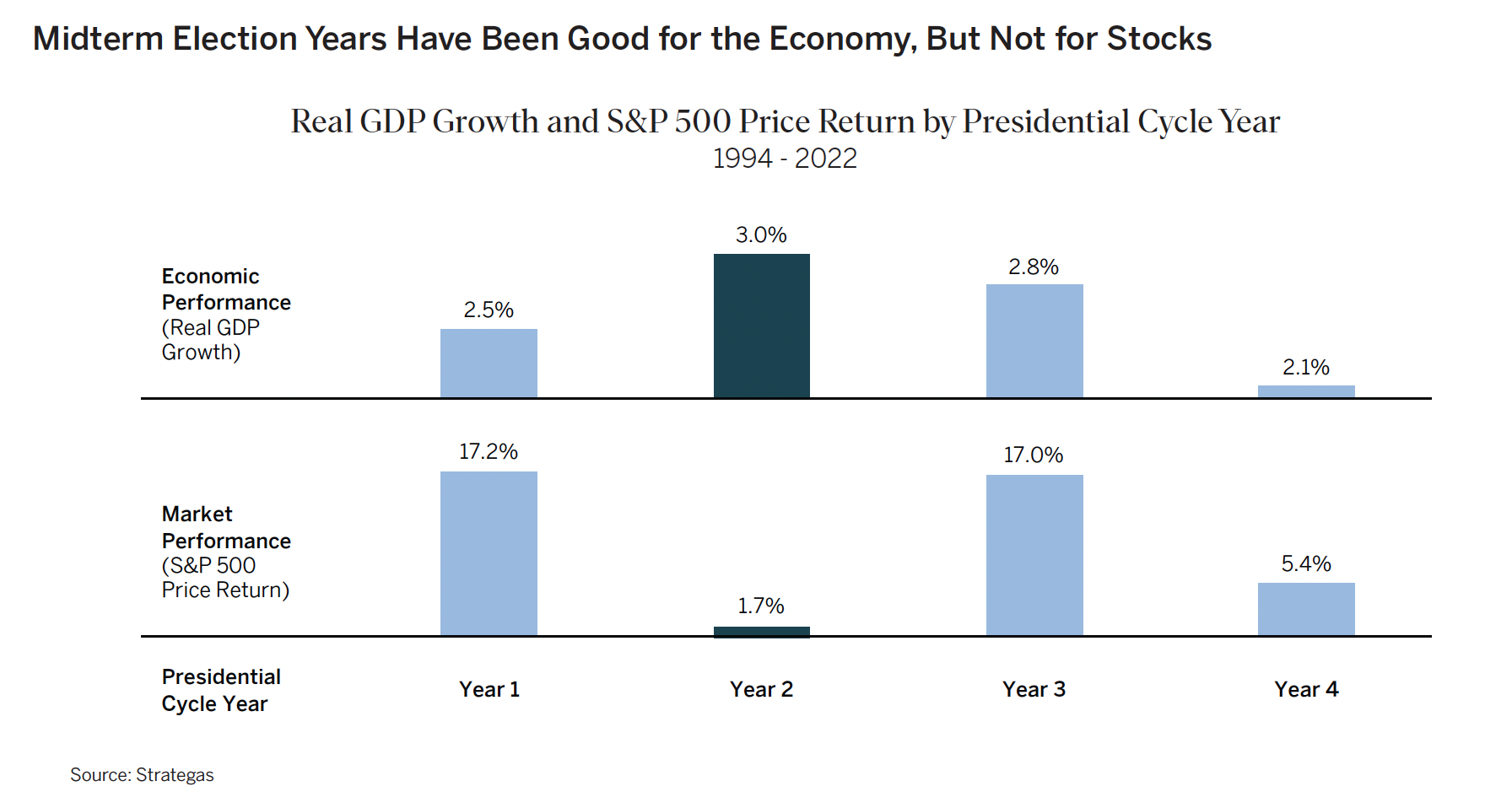

The Curse of the Midterm Election Year: Midterm election years tend to see the strongest economic growth of the four-year U.S. election cycle. But economic strength does not necessarily translate to strong equity market returns. Historically, the second year of the presidential term has delivered the strongest economic growth, but the weakest stock returns, of the four-year election cycle. Equity markets are forward-looking and tend to price in growth before it occurs.

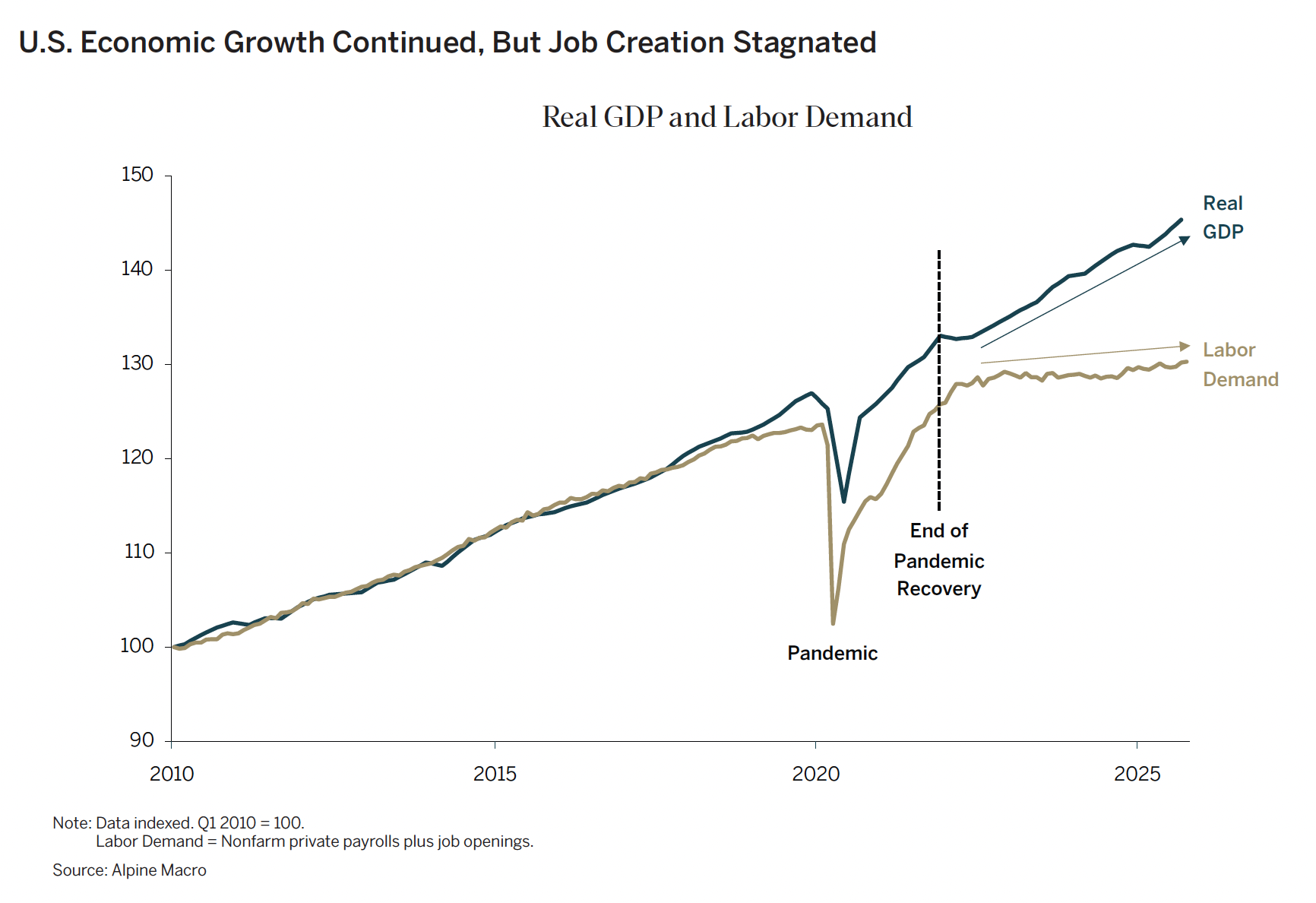

The Unemployment Conundrum: The U.S. economy has two principal weaknesses now. Price levels are still too high for many consumers, and, perhaps more important, job growth is very slow. Typically, the economy and employment grow together. That hasn’t been true recently. While employment bounced back from extreme lows as the pandemic-related shutdown ended, it has barely grown for the last three years.

Although still relatively low at 4.6%, the U.S. unemployment rate is up 1.2 percentage points from its trough in April 2023. It is unclear whether the economy can continue to grow robustly while the labor market languishes. This is the first time that the unemployment rate has risen this much outside of a recession.

AI (Over) Optimism: For the last three years, excitement about the potential of AI has driven very high expectations for sales and earnings for most of the Magnificent Seven (Mag 7)(1) stocks and a few other AI-related companies.

As we have previously written, AI is an extremely capital-intensive and competitive business, unlikely to produce the extraordinary profitability of the prior generation of technology companies, which engaged in “capital light” and naturally monopolistic businesses, such as software, media and advertising. Like research and development (R&D) spending on new drugs, AI capital spending is likely to pay off over longer time horizons and with less certainty than technology investors have come to expect. Today, capital spending and R&D consume a greater share of the sales and gross cash flows of the largest AI providers(2) than R&D does for drug stocks, which trade at much less lofty valuations.

The Mag 7’s weight in the S&P 500 has jumped from approximately 11% in 2015 to almost 35% at the end of 2025. History shows that stocks priced on expectations of exponential future growth can fall sharply if investors lose faith in the narrative. Given the Mag 7’s huge current weight in the S&P 500, a diminution of AI fervor could drag down the index as a whole.

Over the past decade, our thematic research led us to invest in many of the companies now benefiting from AI euphoria for reasons wholly unrelated to AI. Many years of strong cash flow growth from their non-AI business lines allowed them to comfortably afford rapid, large AI investment. Our increasing concern about the future return on AI investment led us to reduce exposure to many of these companies over the last year. We still own several of the Mag 7 stocks, but we hold them at well below their weight in the S&P 500.

THEMATIC UPDATE

Our thematic investment approach is geared to identifying beneficiaries of disruption and investible changes in the global economy. Most of our themes have been in our portfolios for years, although our focus on particular companies changes as themes evolve.

Today, we have five investment themes that we see as rich hunting grounds for the rare companies that can disrupt the status quo in a way that benefits their shareholders.

Two of our themes, The End of Disinflationary Tailwinds and Opportunities Abound Abroad, relate to what we see as seismic changes in the global economy that we believe will lead to new market leadership in the coming years:

▪ Widespread monetary and fiscal policy shifts from economic austerity or restraint to unabashed stimulus and debt growth, and

▪ Protective trade policies that lead to more redundant and less efficient supply chains.

IN CONCLUSION

After the strong performance of the past several years, one can’t know if, when or by how much the U.S. equity market might drop, or how great the impact on the economy will be. Stock markets go up most of the time. Down years are rare. The S&P 500 has only declined in seven of the last 25 years. But the higher frequency of positive returns is partly offset by the greater magnitude of negative returns. Declines can be particularly painful following periods when the market is highly concentrated and richly priced. After the internet bubble burst in 2001, the S&P 500 fell by 49%, and the Nasdaq dropped 78%.

To address this challenge, we adhere to a set of time-tested portfolio- and risk-management practices. These include routinely trimming winning positions. Even though these sales may generate taxable gains, we believe this practice results in client portfolios that are well diversified and able to better withstand periods of turbulence.

We continue to focus our research energies on identifying the next disruptive investment themes and the companies poised to benefit from them. Historically, the long-term outperformance of equities versus fixed income has been driven by less than 5% of companies—superstar stocks that delivered excessive returns. Investing early in these businesses, when their market capitalizations were relatively small and expectations reasonable, has generated strong outperformance for investors.

We approach 2026 glad for the strong year just ended, excited for the future and grateful for our clients’ continued trust in us.

(1) Alphabet (owner of Google), Amazon, Apple, Meta Platforms (owner of Facebook), Microsoft, Nvidia, and Tesla

(2) The largest providers, dubbed hyperscalers, provide corporations with access to the massive, specialized infrastructure needed to train, build and run AI models. The largest five are Amazon Web Services, Microsoft Azure, Google Cloud, Meta and Oracle Cloud. Alibaba Cloud, Tencent Cloud, Byte Dance, NVIDIA’s DGX Cloud and CoreWeave, are other big players.

Important Disclosures This commentary is for informational purposes only. The information set forth herein is of a general nature and does not address the circumstances of any particular individual or entity. You should not construe any information herein as legal, tax, investment, financial or other advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. This commentary includes forward-looking statements, and actual results could differ materially from the views expressed. Materials referenced that were published by outside sources are included for informational purposes only. These sources contain facts and statistics quoted that appear to be reliable, but they may be incomplete or condensed and we do not guarantee their accuracy. Fact and circumstances may be materially different between the time of publication and the present time. Clients with different investment objectives, allocation targets, tax considerations, brokers, account sizes, historical basis in the applicable securities or other considerations will typically be subject to differing investment allocation decisions, including the timing of purchases and sales of specific securities, all of which cause clients to achieve different investment returns. Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any historical performance level(s), be suitable for the portfolio or individual situation of any particular client, or otherwise prove successful. Investing involves risks, including the risk of loss of principal. The level of risk in a client’s portfolio will correspond to the risks of the underlying securities or other assets, which may decrease, sometimes rapidly or unpredictably, due to real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict, trade disputes, sanctions or other government actions, or other general market conditions or factors. Actively managed portfolios are subject to management risk, which involves the chance that security selection or focus on securities in a particular style, market sector or group of companies will cause a portfolio to incur losses or underperform relative to benchmarks or other portfolios with similar investment objectives. Foreign investing involves special risks, including the potential for greater volatility and political, economic and currency risks. Please refer to Chevy Chase Trust’s Form ADV Part 2 Brochure, a copy of which is available upon request, for a more detailed description of the risks associated with Chevy Chase Trust’s investment strategy. The recipient assumes sole responsibility of evaluating the merits and risks associated with the use of any information herein before making any decisions based on such information.