Second Quarter | 2022

Click here for a printable version of the Investment Update.

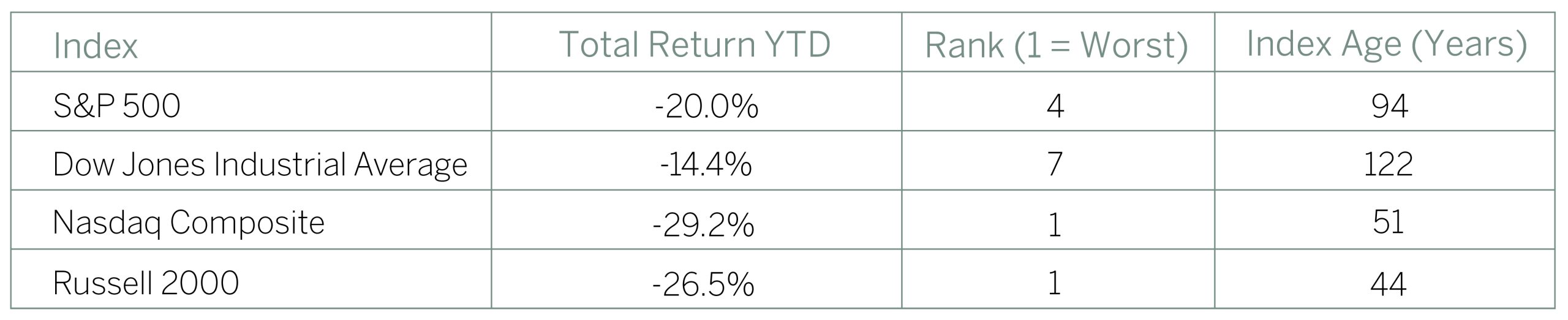

By any measure, 2022’s first half was exceptionally challenging for investors. Even after accounting for dividends, the S&P 500 generated a 20% loss, its worst first-half performance since 1970. Both the growth-focused Nasdaq and the Russell 2000 Index of smaller-cap stocks delivered their worst-ever first-half results in their shorter histories.

2022 Was One of the Worst First Halves for Stocks

(Total Returns Through June 30 Compared to Index History)

Source: Ned Davis

And bonds provided no shelter. The price of the 10-year Treasury bond fell -11.6% in the half, a record drop for any six-month period.

The main driver of this poor performance was inflation, which has reached a 40-year high and is now compelling the U.S. Federal Reserve (“Fed”) and other major central banks to raise rates aggressively. After delaying action in the belief that inflation pressures would ease, the Fed pivoted sharply and increased interest rates repeatedly in the first half of 2022, most recently by 75 basis points. More rate hikes are expected shortly.

Inflation at the Highest Level in 40 Years

(CPI and Core CPI – % Change vs. Prior Year, Seasonally Adjusted)

Source: Federal Reserve Economic Data

1. Core CPI excludes food and energy.

A Long Period of Optimism Ends Abruptly

Very few investors today have experience managing money in a high-inflation environment. Since Fed Chairman Paul Volcker broke the back of inflation in the early 1980s, the U.S. has enjoyed decades of relative price stability. This allowed the Fed to focus monetary policy almost exclusively on stimulating economic growth. Since the end of the Global Financial Crisis in 2009, the Fed has used stimulative monetary techniques, such as quantitative easing and ever-lower interest rates, whenever growth has faltered. Investors came to expect this “Fed Put,” taking the low inflation that underpinned it for granted.

For more than a dozen years, low interest rates, made possible by low levels of inflation, created a Goldilocks environment for both equity and bond investors. When the S&P 500 reached an all-time high of 4,796 on January 3, 2022, it was more than seven times higher than the bottom it hit on March 9, 2009.

While price-to-earnings multiples (what investors are willing to pay for future company profits) doubled during that time, most of the S&P 500’s gains were due to earnings growth, which more than tripled. The downturn this year brought multiples back to below their long-term average, while earnings expectations have remained relatively strong.

S&P 500 Performance

(March 9, 2009 Through June 30, 2022)

Source: FactSet

General sentiment swung rapidly from unbridled optimism at the start of the year to deep pessimism that may be overdone.

- According to the University of Michigan Consumer Sentiment Index, which dates to the early 1960s, consumers have never felt worse, despite a historically low unemployment rate of 3.6%.

- Recent polls show the majority of corporate leaders expect a recession to begin in the next 12 to 18 months.

- Most investors now expect the U.S. to be in a recession by year-end, or think we are in a recession already, and have positioned portfolios very defensively.

Counterintuitively, periods when sentiment is very bearish have historically been good times to buy equities, rather than sell them.

Deep Recession or Mild Contraction?

One question stands paramount: Will it take a deep recession to tame inflation, as in the 1980s, or will a brief, mild economic contraction suffice? If a deep recession unfolds, additional pain in the equity markets is highly likely. If a relatively mild slowdown ensues, we may be closer to a near-term bottom.

The pace and scale of Fed rate hikes have increased the odds of a recession. But we don’t think a deep recession is a foregone conclusion. The extreme imbalances that typically lead to deep recessions, such as an overreliance on debt, broad structural supply overhangs or overinvestment, are hard to find today. On the contrary, household and corporate debt levels are generally manageable.

- Consumer balance sheets are strong. The ratio of household net worth-to-disposable income is 50% higher than at the end of 2019. After a decade of deleveraging, household debt-to-disposable income in the U.S. is down by a third since its peak in 2008.

- Corporate balance sheets are also healthy. Corporations have record cash on their books. Although they have been boosting capital spending rates and hiring at a rapid pace, we don’t see many signs of overinvestment.

We think the Fed is only likely to raise rates to the point that causes a deep recession if, as in the 1980s, that’s the only way to rein in long-term inflation expectations. It is far from clear that such a dramatic move will be necessary. Consumers aren’t buying ahead of expected price increases, which would sustain inflation longer term and cause it to spiral upward. On the contrary, intentions to buy durable goods have fallen precipitously, and employment data is likely to weaken soon.

If, as we expect, inflation begins to decline in the second half of this year, the Fed may pause to give prior rate hikes more time to filter through the economy, moving more slowly than consensus expectations indicate. This would likely be positive for both equities and fixed income.

Of course, a host of unanalyzable factors – such as the course of the war in Ukraine or COVID – could tip the scales. We will monitor these closely, but for now, our base case is that the U.S. will avoid a deep recession, and that the stock market will remain volatile but won’t end 2022 dramatically lower than it is today.

Portfolio Themes and Trading

We began to reposition for inflation nearly two years ago, by adding an End of Disinflationary Tailwinds theme to portfolios in the Fall of 2020. We saw then that the impact from the powerful disinflationary forces of the prior decade was fading, most notably China’s emergence as the world’s factory, and increased labor supply due to Baby Boomers delaying retirement. We also expected the unprecedented fiscal stimulus during the pandemic to fuel a surge in spending.

These insights led us to overweight the Energy sector for the first time in eight years. We also added gold and more defensive holdings to portfolios. At the same time, we began to sell highly appreciated Technology holdings that had become too expensive.

Market volatility has been high this year, and we expect this to persist until investors have greater clarity on how much the Fed will have to raise rates to tame inflation. Volatility is often high during periods of uncertainty. During the bear market of 2000-2002, the Nasdaq rose more than 20% – and then collapsed – six times.

High volatility creates an opportunity for active managers like ourselves to generate gains through shorter-term transactions. Consistent with that view, our trading activity picked up over the past quarter, as more extreme market moves allowed us to both buy and trim some of our core, long-term thematic holdings on attractive terms. We are likely to remain more active in our trading as we await clarity on Fed action.

Times like these require fortitude and a willingness to weather the emotions of a new market reality. We remain committed to our time-tested, four-step Global Thematic Investment process, which relies heavily on our deep thematic research. Our process has steered us successfully through turbulent times in the past. We’re confident that it will do so going forward.

Significant Portfolio Actions in the Second Quarter

Adjustments to Consumer Exposure

In the second quarter of 2022, we continued to adjust the consumer exposure in our portfolio, with an overall goal of balancing higher growth, higher beta names with more stable, lower volatility positions. We trimmed many of our luxury consumer discretionary holdings that had benefited from the tailwinds of our Global Wealth Concentration theme and performed well in the pandemic reopening environment. We established new positions in lower beta consumer names including Target Corporation and Costco Wholesale. Finally, we consolidated our global consumer staple exposure within the End of Disinflationary Tailwinds theme by exiting Unilever plc and adding to Nestle S.A., which we believed is better positioned going forward.

Visa

In the second quarter of 2022, we initiated a position in Visa Inc., one of the largest global payment networks. We see attractive, structural growth opportunities for Visa due to three factors: the increasing digitization of money, driven in part by the global growth of e-commerce and increasing acceptance in emerging markets, new payment flows and partnerships, and a more robust suite of value-added analytical services and capabilities.

Intuitive Surgical

Intuitive Surgical, Inc. is a market leading designer and manufacturer of surgical robotic equipment, including the da Vinci Surgical System. In the second quarter of 2022, we exited our position in Intuitive Surgical, a long time holding within our Next-Generation Automation theme. Management has executed extremely well on their goal of achieving better surgical outcomes, lowering the cost of care, and improving both patient and care team experience. While the addressable market is still large and under penetrated, we believe this opportunity is well understood by the market and priced into the stock. We added to other higher growth thematic holdings during the quarter that had become relatively more attractive.