Does the One Big Beautiful Bill Act Change Your Charitable Giving Plan?

Click here to view the summary.

Click here to download the full version.

The recently passed One Big Beautiful Bill Act (OBBBA) includes changes to the charitable contribution deduction. Beginning January 1, 2026, taxpayers will be subject to a new floor on the charitable deduction and a cap on their total itemized deductions. There is therefore a short window between now and December 31st to take another look at your charitable goals to maximize the benefits of your donations prior to the changes in the law.

Floor on Charitable Contributions

After 2025, the itemized deduction for charitable contributions will be subject to a reduction equal to 0.5% of a taxpayer’s Adjusted Gross Income (AGI). This floor is applicable to all levels of AGI, all filing statuses, all charitable contribution amounts, and is in addition to the existing caps on charitable contributions (more on the caps a bit later).

For example, in 2026, a taxpayer with AGI of $1,000,000 will have $5,000 ($1,000,000 * .005) subtracted from their charitable deduction. If the individual donates $300,000 to charity, the taxpayer’s deduction will be reduced to $295,000. Since the floor is determined by the taxpayer’s AGI and is regardless of the amount contributed, this taxpayer will have the same $5,000 reduction whether the donation is for $10,000, $300,000 or any other amount.

Cap on Total Itemized Deductions

The OBBBA also caps the tax benefit of total itemized deductions for taxpayers subject to the 37% tax bracket. This cap effectively limits the benefit of itemized deductions to a maximum 35% tax rate. After 2025, total itemized deductions for taxpayers in the 37% bracket will be reduced by 2/37 of the lesser of (a) the taxpayer’s total itemized deductions, or (b) the excess of taxable income plus total itemized deductions over the 37% bracket threshold. The 37% bracket amount for 2025 starts at taxable income of $626,351 for single and head of household filers or $751,601 for married taxpayers filing jointly. The threshold amounts are adjusted for inflation each year and are expected to increase for 2026.

For example, in 2026, assume married taxpayers have a combined AGI of $1,000,000, a charitable contribution deduction of $295,000 (for their donation of $300,000) and a $10,000 deduction for State and local taxes, for total itemized deductions of $305,000. The preliminary taxable income is $695,000 ($1,000,000 – $305,000). Using the threshold amounts for 2025, the taxpayers’ itemized deductions would be reduced by $13,427, which represents the lesser of (a) ($305,000 * 2/37) = $16,486 or (b) ($695,000 + $305,000 – $751,600) * 2/37) = $13,427. Total itemized deductions are therefore reduced from $305,000 to $291,573.

Changes to the Ordering of AGI Limits on Charitable Contributions

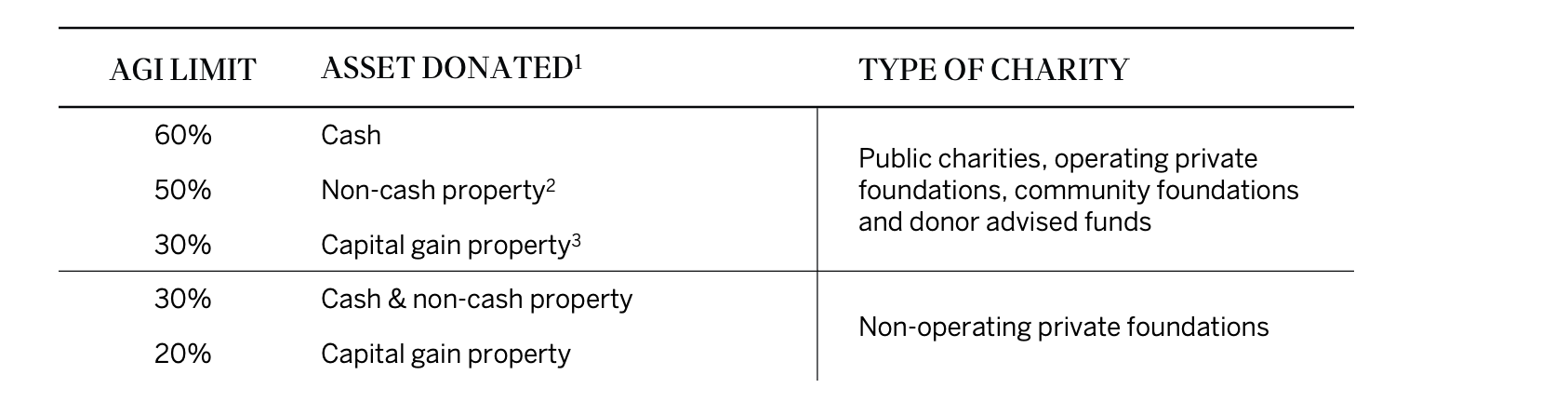

The OBBBA also changes the order in which the AGI limits are calculated for charitable contributions made after 2025. As general background, the following limits are applied to donations of distinct types of property to certain types of charitable organizations.

Currently, the deduction for cash contributions subject to the highest 60% AGI limit is calculated first; the 50% limitation deduction is calculated second and so forth. The new law reverses this ordering after 2025 so that the deduction for charitable contributions subject to the 20% AGI limit is calculated first and the 60% AGI limitation is calculated last. In addition, in 2026, the new charitable floor amount is subtracted from the charitable contributions of the lowest order calculation before determining the AGI limitation.

Any charitable contribution exceeding the applicable AGI limitation, plus any floor amount subtracted from the deductible portion of the contribution, may be carried forward and deducted, subject to the same limitations, for up to the following five years. If contributions do not exceed the AGI limitations, the floor amount is subtracted in the year the contributions are made.

Combined Impact

Combining the previous examples that illustrate the impact of the floor and the AGI limits on charitable contributions as well as the cap on itemized deductions, assume married taxpayers with an AGI of $1,000,000 in 2026 intend to donate cash of $100,000 to public charities and $200,000 of Nvidia stock held long-term to their Donor Advised Fund (DAF). For this example, also assume they can deduct $10,000 of State and local taxes.

The charitable deduction floor amount is $5,000 ($1,000,000 * .005), which reduces the deductible amount of the appreciated stock donation to $195,000 ($200,000 – $5,000). The 30% AGI limit applicable to the appreciated stock contribution is $300,000 ($1,000,000 * 30%). Therefore, $195,000 of the stock contribution is deductible. Next, the cash contribution AGI limitation is $405,000 ($1,000,000 * 60% = $600,000 – the $195,000 stock contribution deduction), so that the entire $100,000 cash contribution is also deductible.

Finally, the itemized deduction cap reduces the total itemized deduction from $305,000 ($295,000 charitable + $10,000 state and local taxes) to $291,573 ($305,000 – $13,427). The total combined reduction in the itemized deductions of $18,427 ($310,000 – $291,573) is lost forever and may have been avoided by accelerating the charitable contributions into 2025 before the effective date of the change in the law.

Using Appreciated, Concentrated Stock Holdings to Achieve Charitable Giving Goals

While a higher AGI limit applies to cash contributions, there is generally an overriding benefit in donating appreciated, publicly traded securities, at least up to the 30% AGI limit for such donations. Donating appreciated securities provides a deduction equal to the fair market value of the stock, avoids taxes on the unrealized capital gain, and reduces a concentration risk in the security. Giving appreciated securities can also preserve your cash for future distributions, expenses, portfolio rebalancing, or other uses.

We recommend that any taxpayer who makes charitable gifts consider using a highly appreciated security such as Nvidia for the donation, particularly if the security has become a concentrated position in the taxpayer’s portfolio. If this is done before the end of 2025, the deduction will not be subject to the 0.5% AGI reduction or the cap on total itemized deductions discussed above.

To illustrate, using a simple example, assume a taxpayer with $1,000,000 of AGI desires to give $300,000 to their DAF in 2025. This donation can then be doled out to charities from the DAF over time. The taxpayer compares donating $300,000 cash to donating $300,000 of Nvidia stock with a cost basis of $10,000. The taxpayer’s combined ordinary income tax rate (federal and state) is 45%. The taxpayer’s combined capital gains tax rate (federal and state) is 30%. Here is the comparison:

Cash donation of $300,000

Value of the tax deduction: $135,000 ($300,000 * 45%)

Net “cost” to the taxpayer: $165,000 ($300,000 – $135,000)

Stock donation of $300,000

Value of the tax deduction: $135,000 ($300,000 * 45%)

Value of the capital gains tax savings: $87,000 (($300,000 – $10,000) * 30%)

Net “cost” to the taxpayer: $78,000 ($300,000 – $135,000 – $87,000)

If stock concentration were not an issue, the taxpayer could use the available cash to buy back the same stock that was donated to charity, with a new tax basis equal to the fair market value of the stock on the date of purchase.

Limited Charitable Deduction for Non-Itemizers

Taxpayers who claim the standard deduction on their tax returns may deduct claim a charitable deduction of up to $2,000 for married taxpayers filing jointly or up to $1,000 for all other taxpayers.

Other Factors to Consider When Making Charitable Giving Decisions after OBBBA

The calculation of the charitable contribution deduction is complex. Factors such as your AGI, non-charitable itemized deductions, state income taxes, the assets you have available to donate, the type of charities you want to support, and your estimated income can all impact your potential tax deduction. The ability of taxpayers who have reached the age of 70-½ to make Qualified Charitable Donations of up to $108,000 (2025 amount) from their IRAs has not been impacted by the new deduction limits and should not be overlooked. A bunching strategy (making larger charitable donations in one year while claiming the standard deduction in other years) should also be considered when the charitable floor and cap limits are substantial.

Collaboration with your financial planner, portfolio manager, tax advisor, and sometimes legal counsel is even more important today when making decisions and executing your charitable giving goals. We recommend you ask your tax advisor to run the numbers to help determine the best strategy for you in any given year.

[1] Qualified conservation contributions of real property to a qualified organization, including a governmental unit and public charities, are limited to 50% of AGI (100% for qualified farmers and ranchers). Disallowed qualified conservation deductions can be carried forward for 15 years.

[2] Non-cash property is property other than cash or capital gain property and includes donations such as clothing, household items, electronics, food items, inventory, works of art, capital assets held one year or less, and capital assets for which the taxpayer elects to deduct the cost basis.

[3] Capital gain property is property that would result in long-term capital gain if it were sold at its Fair Market Value on the date it was contributed.

IRS CIRCULAR 230 DISCLOSURE

Pursuant to IRS Regulations, we inform you that any tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax related penalties or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.