Observations on Private Equity

Click here for a printable version of “Observations on Private Equity”

We do not invest in private equity for our clients, but they often ask about our views on the asset class. We believe private equity can be a suitable investment for certain families and institutions, but the opportunity doesn’t appear attractive at present.

It may be appropriate for investors who are:

It may be appropriate for investors who are:

- Comfortable with the trade-offs it requires when compared to public equities. These trade-offs include long periods of illiquidity, substantial imbedded leverage, subjective valuation of fund investments, iron-clad commitments to meet periodic capital calls, no decision rights for limited partners and higher fees.

- Able to invest across multiple “vintages” of funds. If not, investments may be unduly restricted to the opportunities available in a narrow window of time.

- Confident that they are investing with a top-tier manager. Winning in private equity requires investment acumen, skill in managing portfolio companies, and strategic insight. Such attributes are scarce.

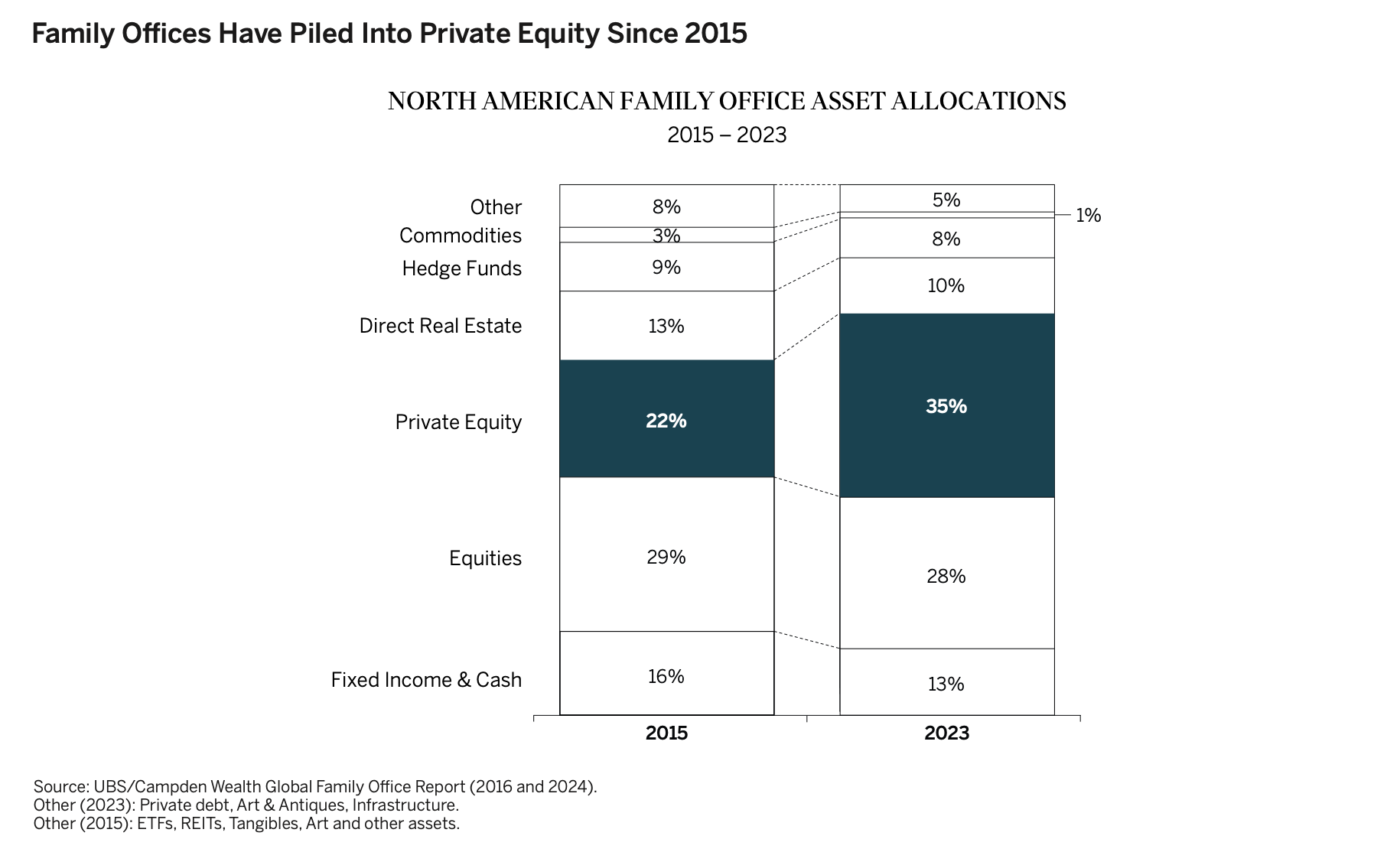

- Today, we think even investors well-suited to private equity should approach it with an extra dose of caution. Barton Biggs, who famously predicted the bursting of the late 1990’s dot-com bubble, warned: “The is no investment idea that is so fantastic that it can’t be spoiled by too much capital.” Capital has flooded into private equity funds over the past two decades. Assets under management mushroomed from $600 billion in 2000 to more than $10 trillion at the end of 2023. Roughly 16 times more capital is pursuing a universe of investable companies that hasn’t changed much, making high returns far harder to come by.

- The private equity industry currently has $3.2 trillion in unsold, leveraged assets that were initially purchased at relatively expensive valuations.

- The number of deals per year has fallen 35% from the peak in 2021, and exit values are down two-thirds on average. With many exit channels closed, returns distributed to investors have slowed.

- Average interest rates on the high levels of debt used to purchase companies have doubled to over 9%, increasing bankruptcy risk for portfolio companies.

- Funds haven’t disclosed write-downs on many private equity fund holdings yet, but we think they will soon, as nearly $300 billion in leveraged loans for private equity transactions come due by the end of 2025. In the meantime, investors may be paying management fees based on overly optimistic company valuations.

No doubt, some will make money in new private equity investments, but the opportunity appears much slimmer, and the risks far greater, than was the case several years ago.