Second Quarter, 2024

Click here for a printable version of the Investment Update.

Equity index returns were strong through the first six months of 2024, driven largely by investor excitement about artificial intelligence (AI). We suspect that the amount of capital chasing the promise of AI will depress future returns. We are focusing on areas that have seen more modest investor interest, including global commodities and Europe.

A STRONG FIRST HALF BUILT ON A NARROW FOUNDATION

Equity markets had a solid second quarter. The S&P 500 generated a total return of 4.3%, bringing its first-half return to 15.3%. But market returns were once again remarkably narrow, concentrated in a few mega-cap stocks benefiting from excitement about artificial intelligence. The top-five contributors to the S&P 500’s performance – Alphabet, Amazon, Meta, Microsoft and Nvidia – drove 58% of the S&P 500’s year-to-date return. Meanwhile, global equity markets, while not as strong as the S&P 500, had a strong quarter and first half. The MSCI All-Country World Index returned 3.0% in the second quarter and 11.6% in the first half of 2024.

AI: “DÉJÀ VU ALL OVER AGAIN”

Barton Biggs, who famously predicted the bursting of the dot-com bubble, warned about the danger of too much capital chasing a trend. “There is no investment idea that is so fantastic that it can’t be spoiled by too much capital,” Biggs said. It is one of our favorite investment maxims. We also believe in the converse: A shortage of capital can make some less exciting investment ideas quite rewarding.

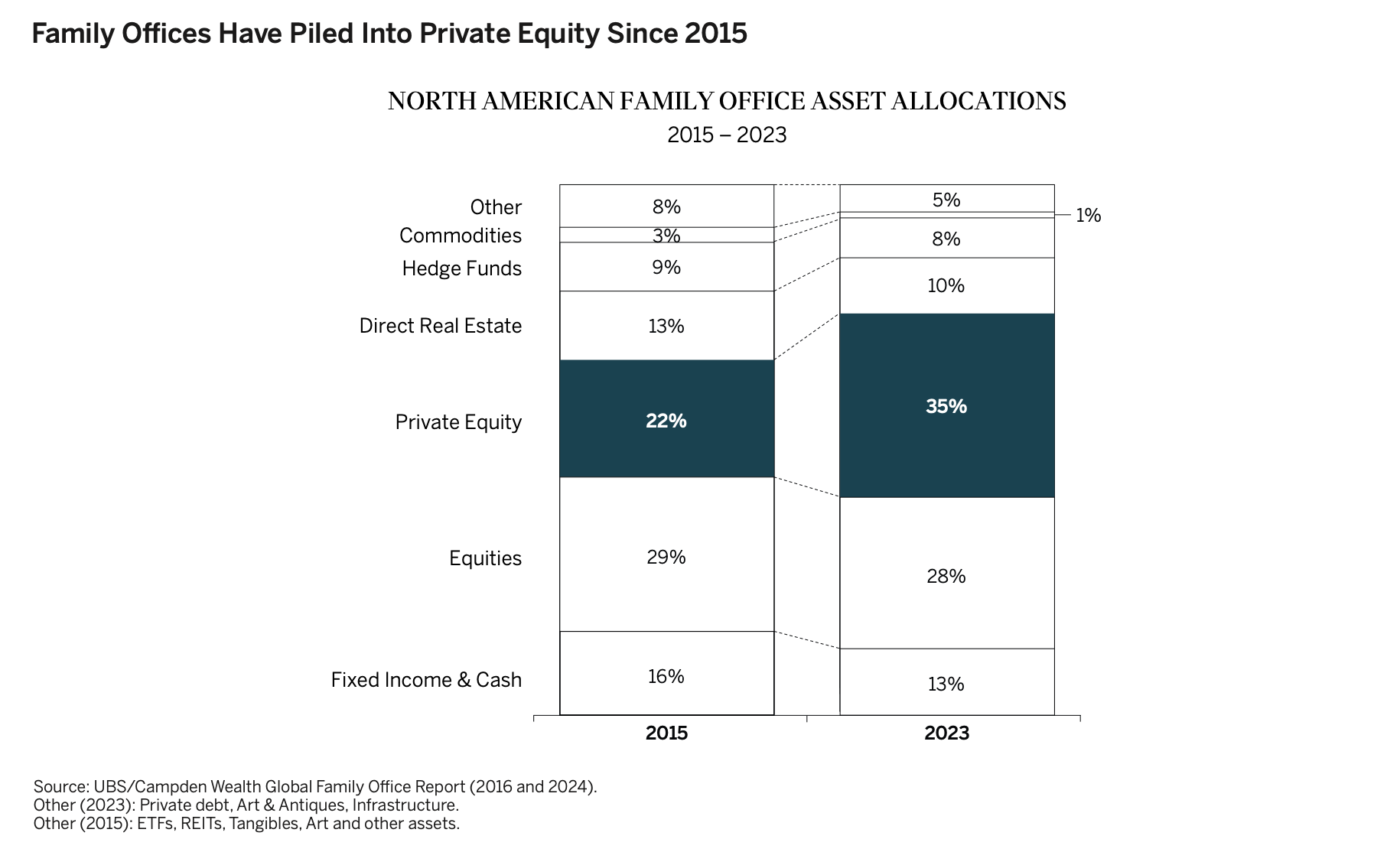

In this Investment Update, we examine AI as a potential bubble by focusing on its greatest beneficiary, Nvidia. Then, we will examine two investment areas that we find compelling, largely because they’ve been starved of capital for quite some time: Europe and global commodities. Finally, we briefly address Private Equity, a topic of frequent interest among our clients and another area where Biggs’ maxim of too much capital may apply today.

NVIDIA: KING OF AI

In its 2021 and 2022 fiscal years,1 Nvidia revenue growth was flat, with the firm generating roughly $27 billion in sales each year. As of March 2023, consensus analyst expectations called for low double-digit revenue growth, with $30 billion in sales projected in 2023 and $37 billion in 2024.2 But results dwarfed expectations. The company generated $61 billion in 2023. Nvidia is now projected to generate revenue of $120 billion in 2024.

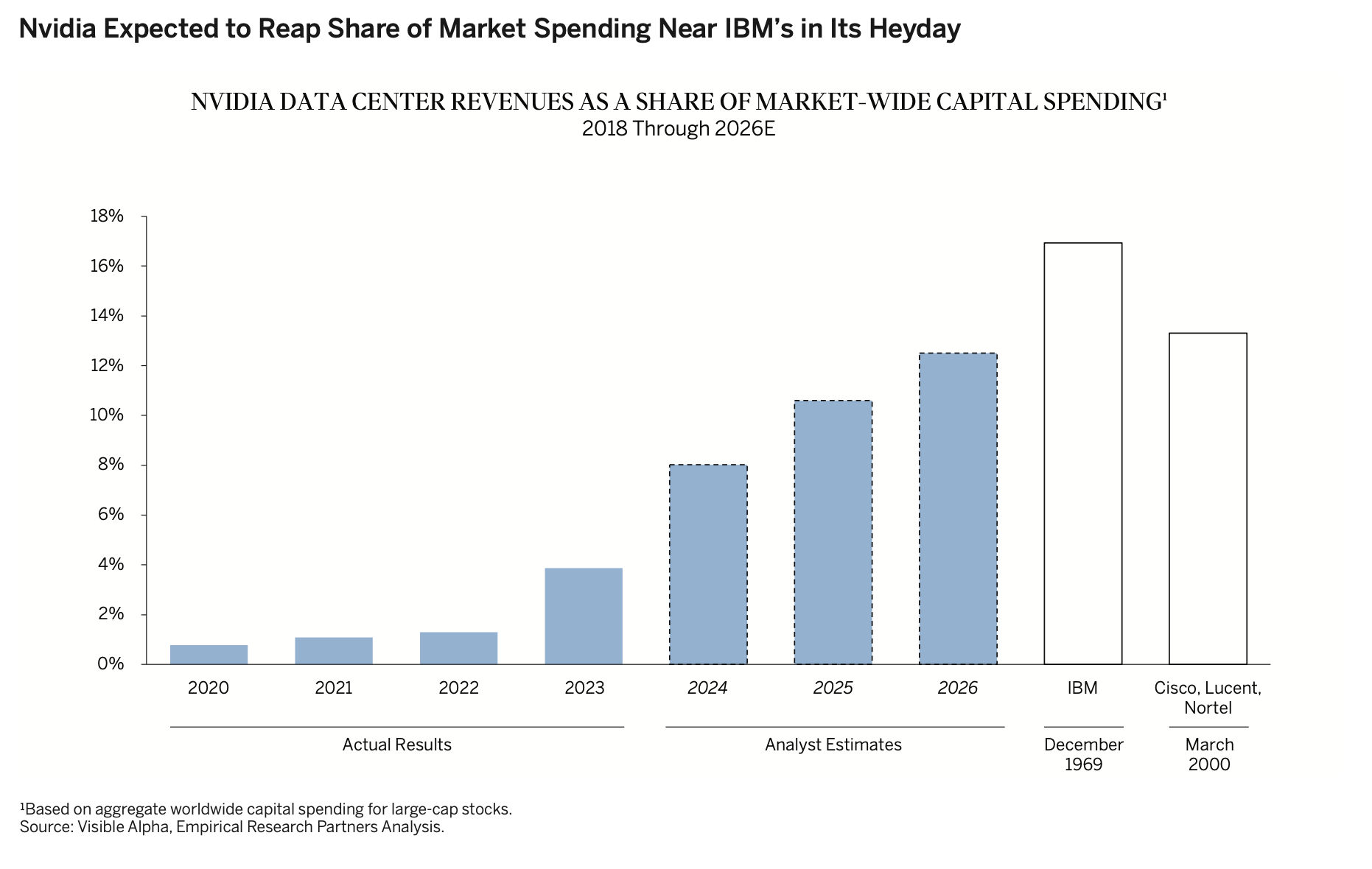

Why? Graphic processing units (GPUs), which Nvidia invented in 1999 and which set off the computer gaming craze, have become essential to data centers managing large language models and other AI technologies. Nvidia’s biggest customers are well-capitalized technology firms, and many of them view AI as an existential threat to their core businesses. These companies are willing and able to spend virtually any amount of money to ensure they don’t fall behind in the race to deploy AI. Analysts now forecast that 12% of all global capital spending (capex) by large-cap firms will be funneled to Nvidia’s data center business. That’s extraordinary, comparable only to IBM’s share during the mainframe era or the combined share of Cisco, Lucent and Nortel at the peak of the tech and telecom bubble.

Nvidia first came to our attention well over a decade ago, as part of our research in our Advent of Molecular Medicine theme. Scientists, then struggling to process the vast amount of data generated by genomic sequencing, told us they were increasingly turning to GPUs, rather than the central processing units (CPUs) in most computers at that time. We figured data-intensive applications would be developed in other sectors as well, broadening Nvidia’s potential market.

Nvidia first came to our attention well over a decade ago, as part of our research in our Advent of Molecular Medicine theme. Scientists, then struggling to process the vast amount of data generated by genomic sequencing, told us they were increasingly turning to GPUs, rather than the central processing units (CPUs) in most computers at that time. We figured data-intensive applications would be developed in other sectors as well, broadening Nvidia’s potential market.While AI euphoria shows no signs of abating, it is not clear that there will be sufficient uses for AI any time soon to justify the enormous capital expenditures underway. Even if sufficient uses emerge, it’s unclear whether AI service providers will be able to maintain pricing at levels that would make their investments profitable. AI searches now cost approximately 10 times more than a traditional Google search. Will users or advertisers be willing to pay that much more to use AI?

Sequoia, a Silicon Valley venture-capital firm, estimates that the technology industry spent $50 billion on Nvidia chips to train AI models in 2023 but brought in only $3 billion in revenue. Clearly, tech companies must see far better returns from AI to sustain and grow their investments.

Today, Nvidia cannot produce enough chips to meet demand. But when the company runs through its current order backlog, profitable new uses for AI will have to drive growth. If these don’t emerge, excess Nvidia chips will likely be resold on the secondary market at heavily discounted prices, and disappointed investors will drive the stock price down.

Given this uncertainty, we think it is prudent to continue to trim AI-related exposures like Nvidia, allowing us to redeploy the capital raised in areas that are not as “hot.” Two such areas that are attracting our research team’s attention are European equities and global commodity infrastructure.

EUROPE: RECOVERING AND UNDERAPPRECIATED

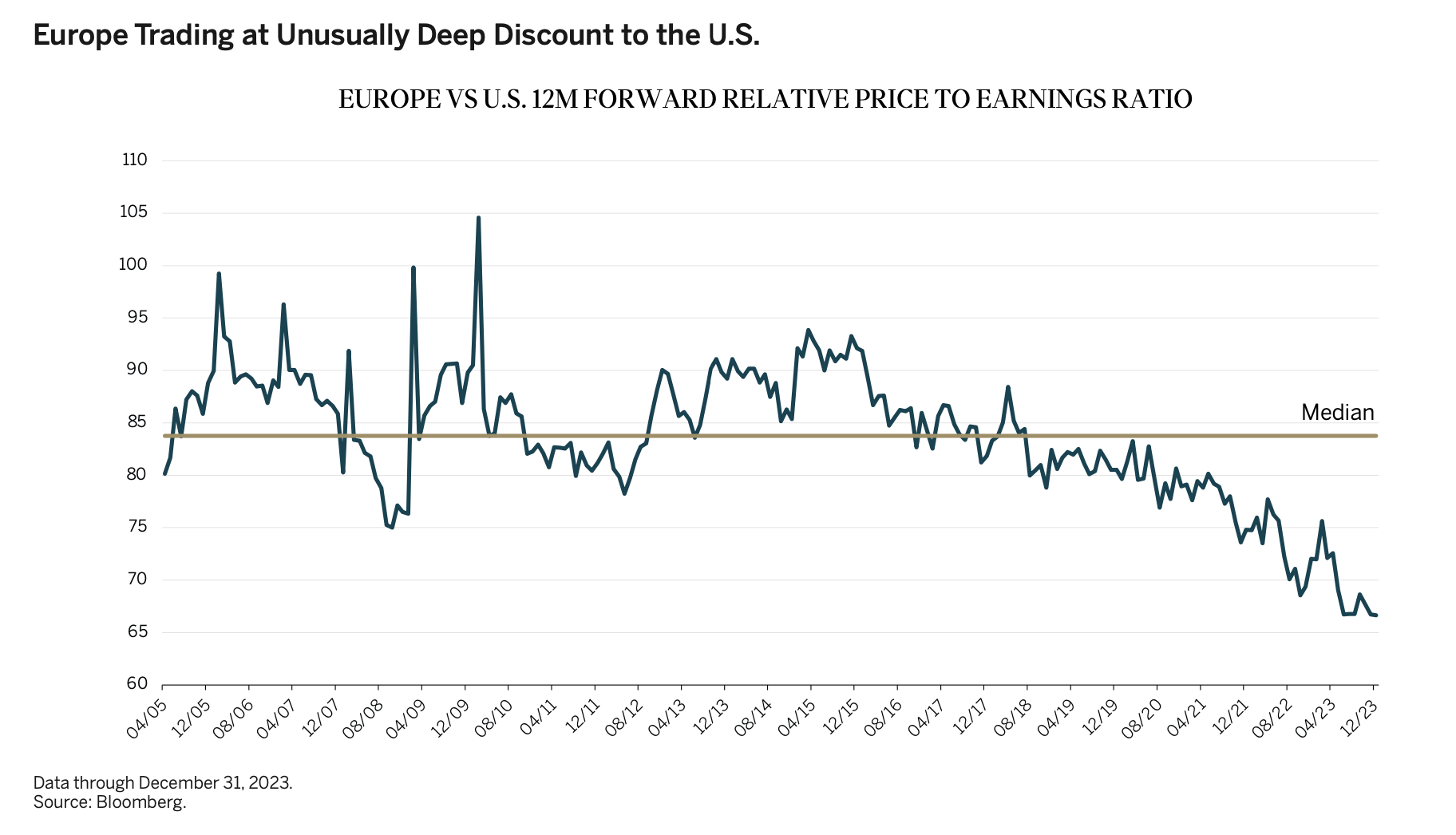

With valuations so low and expectations for Eurozone GDP growth of only 0.8% in 2024, the bar is low for European stocks to outperform U.S. stocks over the coming years.

We see several reasons for optimism:

- Support for European integration is high and broad: Belief that a more cohesive European Union is good for the region’s long-term economic future is becoming increasingly widespread. Even Marine Le Pen, the leader of France’s far-right National Rally party, no longer advocates for a break-up. Her popularity soared when she dropped anti-Euro policies from her party’s platform.

- Regulatory impediments to growth are under attack: Mario Draghi, the former head of the European Central Bank and Prime Minister of Italy, is expected to deliver a report on European competitiveness this summer calling for even deeper capital markets integration, which would enable companies to raise capital more easily. The report is also expected to warn against implementing regulatory requirements, such as the onerous Basel standards for the international financial sector, or adopting more stringent climate-related targets, before the rest of the world. Others are advocating for this as well.

- Europe’s energy crisis is over: With the war in Ukraine disrupting supply, European natural gas prices rose from €25 per megawatt hour (MWh) in the summer of 2021 to €340 per MWh in September of 2022. Thanks to recent large investments in energy infrastructure, gas prices are now back down to €35 per MWh. We expect these lower costs to lead to higher industrial production and corporate profitability.

- Inflation is lower and interest rates are falling: Over the past two years, inflation has eroded household purchasing power and reduced consumer spending, and the rising cost of credit has depressed bank lending. But now, lower inflation and the first round of European Central Bank rate cuts (which began on June 20) may unleash consumer spending and bank lending.

Despite investor disappointment over the past decade, we see the Eurozone as a coiled spring, with the potential for impressive growth. Recent data suggest the economic recovery has begun. While U.S. economic data surprises were modestly negative in April and May of this year, economic activity in Europe has improved. Declining inflation has led to positive real wage growth, and consumer confidence is rebounding. With excess savings equal to 12.5% of GDP (vs. 3.9% for U.S. consumers), we expect European consumer spending to rise, bolstering the overall economy and the prices for many shares.

Important Disclosures This commentary is for informational purposes only. The information set forth herein is of a general nature and does not address the circumstances of any particular individual or entity. You should not construe any information herein as legal, tax, investment, financial or other advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. This commentary includes forward-looking statements, and actual results could differ materially from the views expressed. Materials referenced that were published by outside sources are included for informational purposes only. These sources contain facts and statistics quoted that appear to be reliable, but they may be incomplete or condensed and we do not guarantee their accuracy. Fact and circumstances may be materially different between the time of publication and the present time. Clients with different investment objectives, allocation targets, tax considerations, brokers, account sizes, historical basis in the applicable securities or other considerations will typically be subject to differing investment allocation decisions, including the timing of purchases and sales of specific securities, all of which cause clients to achieve different investment returns. Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any historical performance level(s), be suitable for the portfolio or individual situation of any particular client, or otherwise prove successful. Investing involves risks, including the risk of loss of principal. The level of risk in a client’s portfolio will correspond to the risks of the underlying securities or other assets, which may decrease, sometimes rapidly or unpredictably, due to real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict, trade disputes, sanctions or other government actions, or other general market conditions or factors. Actively managed portfolios are subject to management risk, which involves the chance that security selection or focus on securities in a particular style, market sector or group of companies will cause a portfolio to incur losses or underperform relative to benchmarks or other portfolios with similar investment objectives. Foreign investing involves special risks, including the potential for greater volatility and political, economic and currency risks. Please refer to Chevy Chase Trust’s Form ADV Part 2 Brochure, a copy of which is available upon request, for a more detailed description of the risks associated with Chevy Chase Trust’s investment strategy. The recipient assumes sole responsibility of evaluating the merits and risks associated with the use of any information herein before making any decisions based on such information.