Second Quarter, 2025

Click here for a printable version of the Investment Update.

Listen to our latest Investment Update on Apple Podcasts, Pandora or Spotify.

Chevy Chase Trust’s unique approach to Thematic Investing weaves together multiple themes across sectors, geographies, and industries, each designed to capitalize on research-driven insights. Listen to our quarterly update of economic conditions and investment strategy.

Everything we do starts with a conversation. Understanding your unique story is key in the development of a plan with your best interests in mind. To connect with us to learn more and begin a conversation, visit chevychasetrust.com.

To read the Q4 2025 Investment Update, visit https://chevychasetrust.com/fourth-quarter-2025/. For more information about Chevy Chase Trust, visit chevychasetrust.com.

Important Disclosures This commentary is for informational purposes only. The information set forth herein is of a general nature and does not address the circumstances of any particular individual or entity. You should not construe any information herein as legal, tax, investment, financial or other advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. This commentary includes forward-looking statements, and actual results could differ materially from the views expressed. Materials referenced that were published by outside sources are included for informational purposes only. These sources contain facts and statistics quoted that appear to be reliable, but they may be incomplete or condensed and we do not guarantee their accuracy. Fact and circumstances may be materially different between the time of publication and the present time. Clients with different investment objectives, allocation targets, tax considerations, brokers, account sizes, historical basis in the applicable securities or other considerations will typically be subject to differing investment allocation decisions, including the timing of purchases and sales of specific securities, all of which cause clients to achieve different investment returns. Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any historical performance level(s), be suitable for the portfolio or individual situation of any particular client, or otherwise prove successful. Investing involves risks, including the risk of loss of principal. The level of risk in a client’s portfolio will correspond to the risks of the underlying securities or other assets, which may decrease, sometimes rapidly or unpredictably, due to real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict, trade disputes, sanctions or other government actions, or other general market conditions or factors. Actively managed portfolios are subject to management risk, which involves the chance that security selection or focus on securities in a particular style, market sector or group of companies will cause a portfolio to incur losses or underperform relative to benchmarks or other portfolios with similar investment objectives. Foreign investing involves special risks, including the potential for greater volatility and political, economic and currency risks. Please refer to Chevy Chase Trust’s Form ADV Part 2 Brochure, a copy of which is available upon request, for a more detailed description of the risks associated with Chevy Chase Trust’s investment strategy. The recipient assumes sole responsibility of evaluating the merits and risks associated with the use of any information herein before making any decisions based on such information.

“There are decades where nothing happens, and weeks when decades happen,” Vladimir Lenin famously said. The first half of 2025 seems like the latter: a brief period in which decades of transformative change occurred. U.S. equity markets appear optimistic that these changes will not hurt companies’ ability to generate ever higher profit margins. We have our doubts and believe that a more balanced, discerning investment approach is more important now than ever.

If one looked only at the S&P 500’s beginning and ending levels, one might conclude that not much happened in the first half of 2025. The Index opened on January 2 at 5,903 and closed on June 30 at 6,205, generating a 6.2% total return over six months. Similarly, 10-year U.S. Treasury yields started the year at 4.54% and finished slightly lower, at 4.23%. The similarity of the endpoints, however, masks ample volatility, triggered by three largely unrelated shocks.

- Chinese tech rivalry: In January, news of a Chinese artificial intelligence (“AI”) model named DeepSeek caused a sharp fall in high-flying tech stocks, such as Nvidia. DeepSeek’s technical capabilities and significantly lower production cost led many observers to conclude that U.S. dominance in technology is nearing an end.

- Sky-high tariffs: On “Liberation Day” (April 2), the U.S. announced that it was imposing tariffs ranging from 10% to 50% on roughly 200 trading partners, claiming that unfair terms of trade had hurt U.S. manufacturing. The S&P 500 fell over 12% in justfour trading Investors feared that this abrupt reversal of the long trend toward tariff-free trade and global integration of manufacturing would slow economic growth and raise inflation.

- War: On June 13, Israel bombed several military and political targets in Iran, claiming Iran was close to producing a nuclear Just nine days later, the U.S. bombed three Iranian nuclear facilities. Oil prices spiked over 15% in June on investor fears that the war would keep Iran’s 3.3 million barrels of daily oil production from the global market.

U.S. equity markets snapped back after each shock. Fear of the U.S. losing its dominance in tech subsided as four tech giants (Alphabet, Microsoft, Meta and Amazon) increased capital spending and reiterated their optimistic projections for AI. Fear of tariffs evaporated when, just a week after “Liberation Day,” the U.S. announced it would pause implementation for at least 90 days. It took just a few hours for fear of war to subside, as equity investors recalled that armed conflict usually stimulates economic growth and equity performance.

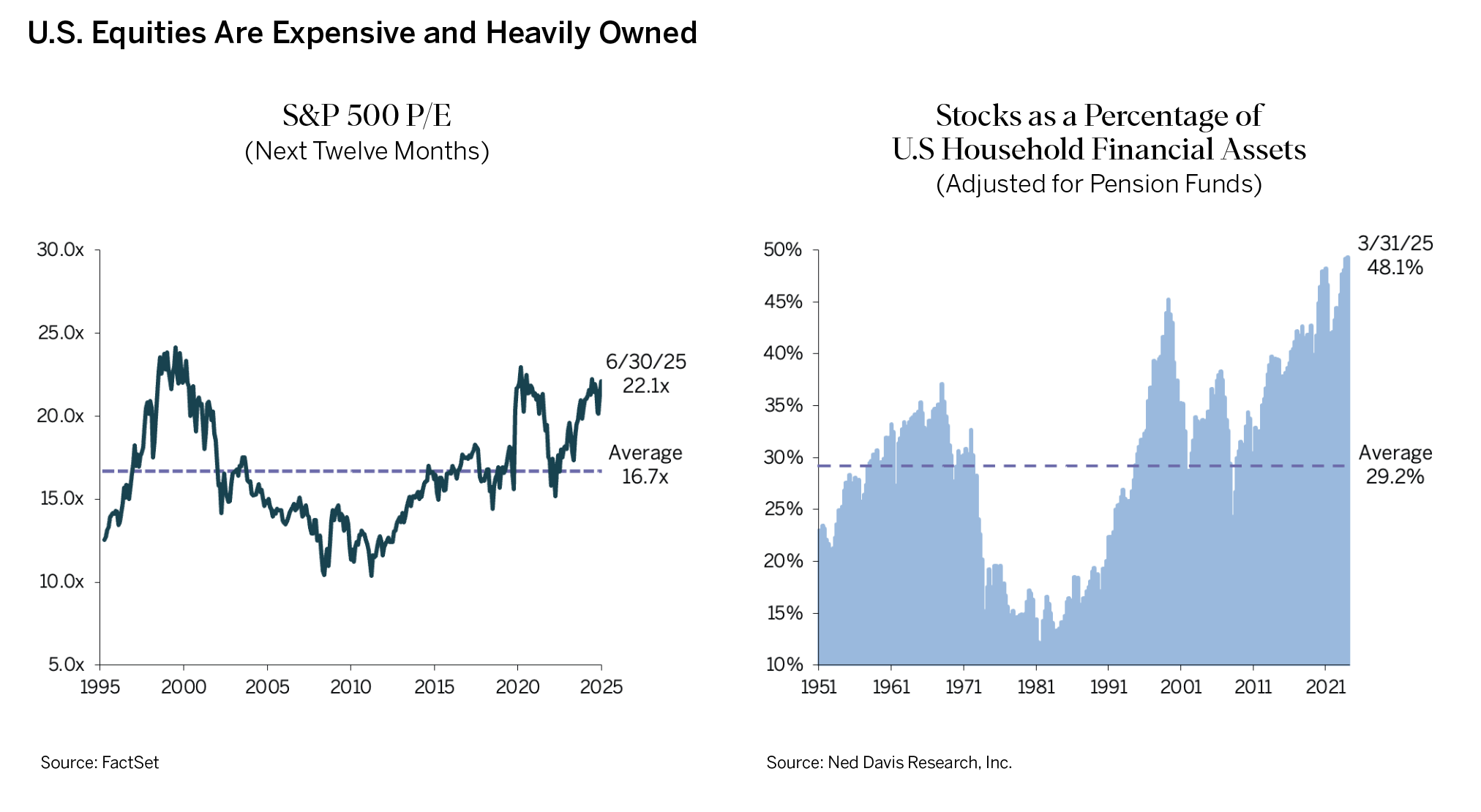

These market snap backs reinforced the “buy the dip” mentality that has driven equity investors for most of the past decade. After falling almost 20% from February 19 to April 8, it took only 55 trading days for the S&P 500 to set a new all-time high. Never before has the S&P rebounded from a decline of over 15% to an all-time high in a shorter period of time. Investors appear to have jumped right back to an all-in bet that AI-driven productivity gains will fuel continued declines in inflation and solid earnings growth. Consensus expectations call for two interest rate cuts in the second half of 2025 and strong earnings growth of almost 7%. While not impossible, this scenario is not probable in our view. The recent rebound leaves U.S. equity market valuations near their all-time high and “over-owned,” particularly by U.S. households.

Investors in U.S. fixed income and currency markets appear notably less sanguine. The yield on 10-Year U.S. Treasuries rose and the U.S. dollar fell during the April equity market selloff. That is highly unusual. In every crisis-driven equity market drop for the past 50 years, global investors flocked to the safety of U.S. Treasuries and the U.S. dollar, which drove yields lower and lifted the dollar’s value versus other currencies. The fact that the opposite occurred during this crisis may prove to be a significant turning point in the U.S.’s role in global financial markets. Only time will tell.

WHAT IF GLOBALIZATION REVERSES?

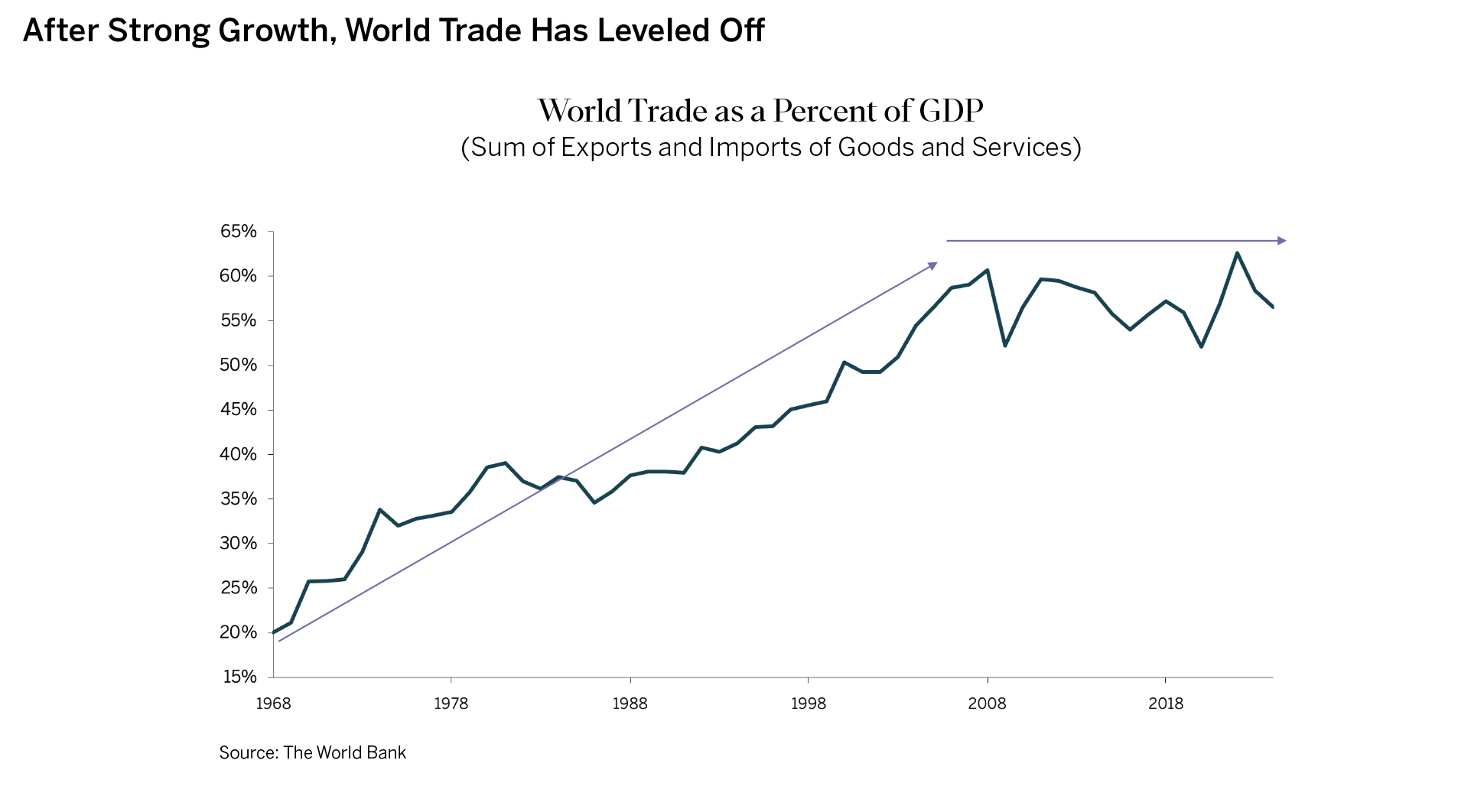

Global integration had been underway for many decades when it began to speed up in the early 1990s. First, after the Berlin Wall fell, capital began pouring out of the West in search of opportunities in Eastern Europe, Asia and other emerging markets. Then, in 2001, China joined the World Trade Organization, setting off a surge in global trade that deepened the integration of manufacturing and supply chains. Companies relocated production to regions where labor and other inputs (including energy) were available at lower cost, and they could sell to local consumers. Global trade continued to grow meaningfully as a share of GDP until the Global Financial Crisis of 2008-2009. Since then, it has bounced around that peak level.

Globalization has its advocates and its critics, but deepening economic integration over decades has led to two undeniable trends in the world economy:

- Developing economies, most notably China, experienced a dramatic rise in per capita GDP, due to rapid export growth, sustained capital inflows and rising productivity, and

- The prices of globally traded goods fell significantly relative to prices of other goods, bringing down overall inflation. Consequently, interest rates in high-income countries fell steadily in both real and nominal terms.

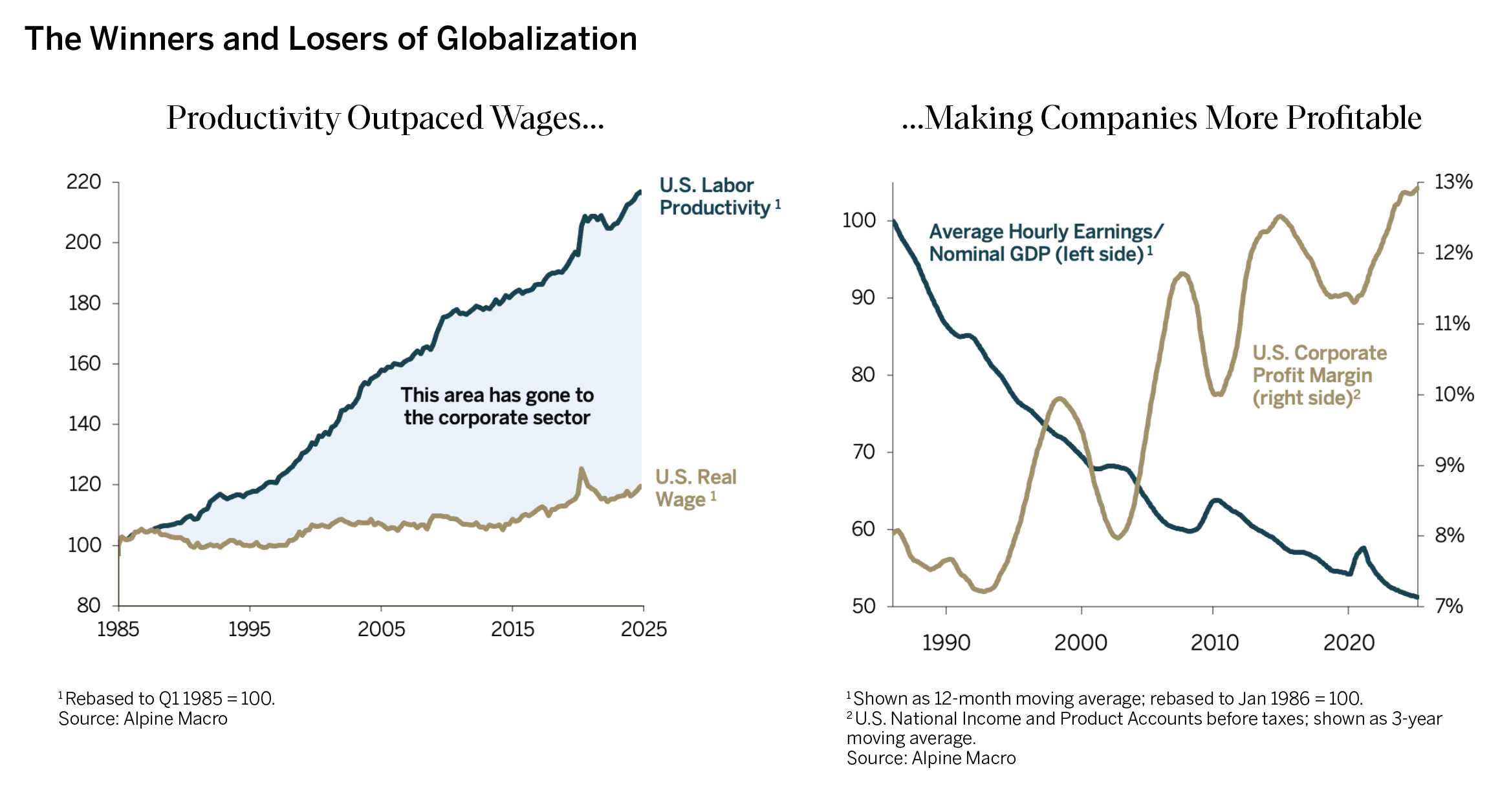

The largest beneficiaries of these trends were Chinese labor, U.S. multinationals and global owners of capital (investors). The biggest losers were factory workers in the developed world. Since 1990, over 800 million people in China have been lifted out of extreme poverty. Western businesses and U.S. multinationals also reaped massive gains. Moving production offshore boosted corporate profit margins and eroded labor’s bargaining power, allowing the business sector to take a larger share of national income.

Real wages for American workers have lagged behind output per worker, and wages as a share of GDP have dropped steadily since the late 1980s. At the same time, corporate profit margins have expanded to an unprecedented level.

Expanding profit margins encouraged massive inflows of foreign capital into U.S. financial markets, which both reduced the cost of capital for U.S. companies relative to their foreign peers and lifted U.S. asset values.

All else being equal, declining global integration will lead to:

- Higher prices for goods,

- Higher interest rates,

- Higher wages, and

- Lower corporate profit margins.

Few economists will argue that the net economic benefit of tariffs and other trade barriers is positive. However, several non-economic rationales, including national security, may justify trade barriers in certain sectors.

If the Trump Administration ultimately succeeds in imposing higher U.S. tariffs, and thereby reduces U.S. consumption of imports, foreign countries can choose one of two paths: either produce fewer goods or consume more. If too many countries opt to produce less, a global recession would likely ensue. If enough opt to consume more, the global economy will likely become more balanced and grow faster, but with a greater share of the growth generated outside the U.S.

Both Europe and China appear to be choosing to encourage greater consumption. Both regions have increased fiscal stimulus and lowered interest rates. In the short term, reduced U.S. demand for imports would create excess manufacturing capacity and likely spur non-U.S. suppliers to lower prices, reducing inflation abroad. Longer term, other nations choosing to run their economies “hot” will likely lead to higher inflation everywhere, less efficient supply chains and greater demand for commodities and infrastructure.

THEMATIC UPDATE

Equity investors may be starting to discount this possibility. Markets outside the U.S. outperformed the S&P 500 in the first half of 2025. The MSCI All Country World ex USA Index generated a total return of 17.9% year-to-date. We continue to see attractive investment opportunities in both our End of Disinflationary Tailwinds and Opportunities Abound Abroad themes.

We are actively adjusting the emphasis in our Heterogeneous Computing theme. To date, it has focused primarily on semiconductors and technology hardware and equipment stocks, many of which greatly benefited from the AI-related capital spending boom. We are shifting our focus towards software, services and applications that are well-positioned to capitalize on the infrastructure spending that has already occurred.

While we believe that AI has great long-term potential, we worry that the market is overly optimistic about its short-term impact. For example, The Carlyle Group estimates that more than $1.8 trillion will be spent on AI infrastructure by the end of the decade. But according to Coatue, another global investment firm, the combined sales of AI services are projected to be less than $20 billion in 2025. Even if AI service revenue doubles every year for the next five years, the aggregate revenue generated over those years would cover only about 70% of the projected capital spending. Few would consider that to be an acceptable rate of return. As companies and investors stare at this possibility, we expect the rapid growth in AI-related capital spending to level off in the quarters ahead.

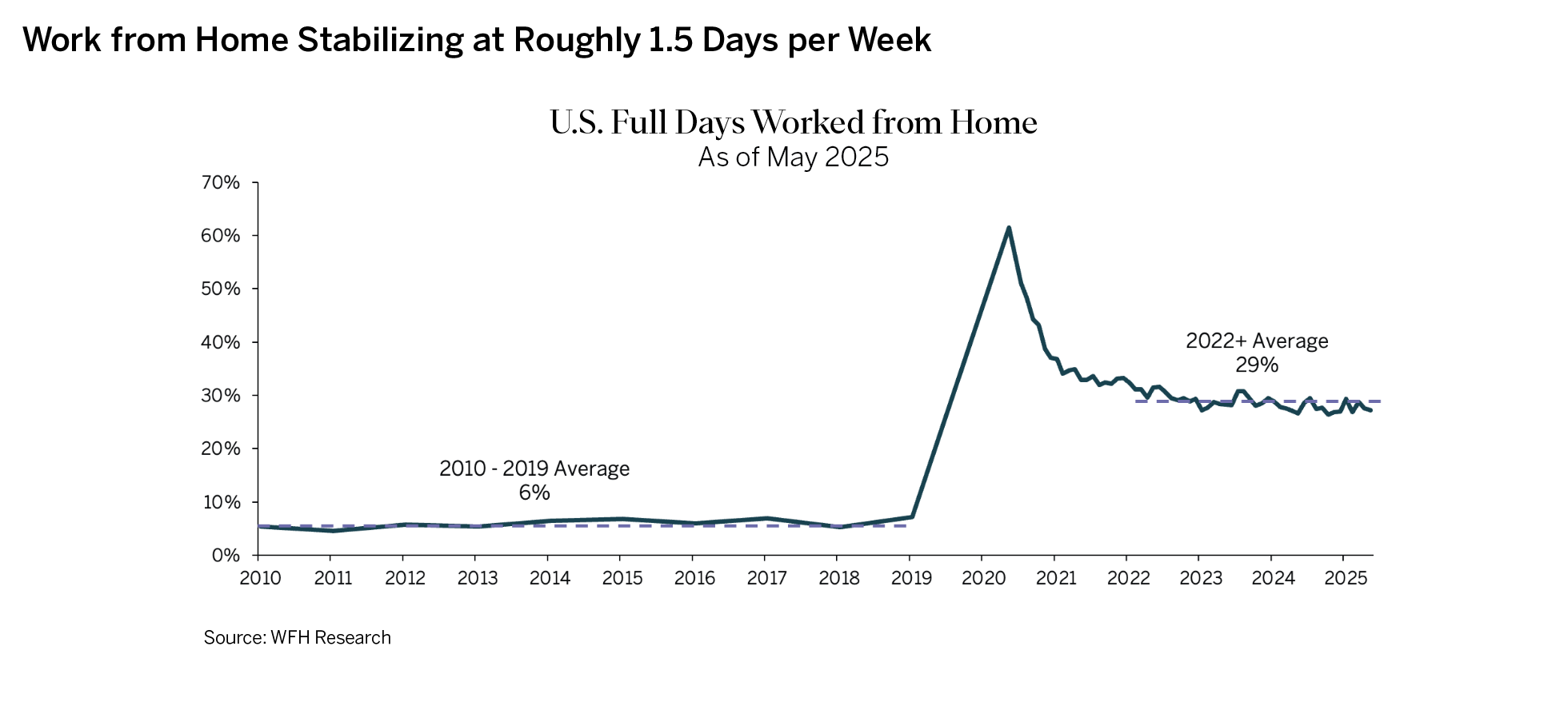

We are phasing out our Post-Pandemic Consumer theme. While work-from-home and other lifestyle changes ushered in by the pandemic are likely to persist, we think these trends are now reflected in current valuations.

We believe global markets are still digesting the long-term implications of the policy changes and geopolitical events of the past six months. The magnitude of these changes suggests the reverberations will be significant, but unfold over years, not months or weeks. We remain intensely focused on our deep Thematic research. We are actively working on a new theme that we may introduce to portfolios in the second half of this year if our research substantiates some of our initial hypotheses. More generally, we continue to position portfolios relatively conservatively and look abroad for new opportunities. We are grateful for our clients’ continued support in this endeavor.

Important Disclosures This commentary is for informational purposes only. The information set forth herein is of a general nature and does not address the circumstances of any particular individual or entity. You should not construe any information herein as legal, tax, investment, financial or other advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. This commentary includes forward-looking statements, and actual results could differ materially from the views expressed. Materials referenced that were published by outside sources are included for informational purposes only. These sources contain facts and statistics quoted that appear to be reliable, but they may be incomplete or condensed and we do not guarantee their accuracy. Fact and circumstances may be materially different between the time of publication and the present time. Clients with different investment objectives, allocation targets, tax considerations, brokers, account sizes, historical basis in the applicable securities or other considerations will typically be subject to differing investment allocation decisions, including the timing of purchases and sales of specific securities, all of which cause clients to achieve different investment returns. Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any historical performance level(s), be suitable for the portfolio or individual situation of any particular client, or otherwise prove successful. Investing involves risks, including the risk of loss of principal. The level of risk in a client’s portfolio will correspond to the risks of the underlying securities or other assets, which may decrease, sometimes rapidly or unpredictably, due to real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict, trade disputes, sanctions or other government actions, or other general market conditions or factors. Actively managed portfolios are subject to management risk, which involves the chance that security selection or focus on securities in a particular style, market sector or group of companies will cause a portfolio to incur losses or underperform relative to benchmarks or other portfolios with similar investment objectives. Foreign investing involves special risks, including the potential for greater volatility and political, economic and currency risks. Please refer to Chevy Chase Trust’s Form ADV Part 2 Brochure, a copy of which is available upon request, for a more detailed description of the risks associated with Chevy Chase Trust’s investment strategy. The recipient assumes sole responsibility of evaluating the merits and risks associated with the use of any information herein before making any decisions based on such information.